Spend oneself an allocation, and employ it for everybody discretionary spending. Pull bucks from the handbag to blow has been proven to end in even more psychological discomfort than just whipping out of the vinyl otherwise pressing buy. So embrace the pain sensation now and luxuriate in a far greater future.

Live smaller high

If or not you could shell out $five hundred a month otherwise $fifty,000 30 days for rental, save money. Look for a less costly place. Score a roomie. Set this new thermostat lower in winter season and higher in the summer. Discover ways to plan and you may eat fresh restaurants in the place of purchasing canned otherwise fun. You will also save well on scientific expenses. Lose your own gymnasium subscription and you may run-in the new park having friends. Indeed, it whole do so would-be smoother whenever you can enlist the help of nearest and dearest who’ve the same goal – financial protection and purchasing a property.

Change your designs to own 1 month and watch just how much you save your self. Not only will you increase your own personal discounts; you will become doing having homeownership – understanding how to accept quicker.

Raise discounts

One of the because of the-issues regarding living with faster would be the fact you can cut far more. You should never also think of saving to possess property unless you enjoys sufficient crisis coupons to cover at the least a few months off expenses (six while self-operating or towards commission).

Get your saving habit over to an effective start by good garage profit or spend the big date which have an application like Letgo or really works your own ebay account. Lose that which you don’t require nowadays and set it with the discounts. Same thing to possess windfalls particularly income tax refunds or gift suggestions. Eliminate yourse a small, however, lender a lot of they.

Double up

New earning and you can household-to acquire rates significantly more than was for each people. When you convey more earners, you really have alot more purchasing strength. This does not mean you truly must be hitched so you can co-very own a house with some one. Otherwise romantically with it. You simply need a partner with similar activities who is as well as in control and you will sick and tired of to make their unique property owner steeped.

You will want to put your co-ownership on paper – just how it is possible to purchase, how you’ll be able to divide expenses and control, and exactly how you can dissolve the fresh new agreement during the attempting to sell time.

Multiply

Another way out of growing what you are able buy should be to believe multifamily homes. Men and women is characteristics with a few, three to four products. You reside you to definitely, rent out the remainder, and rehearse the bucks to spend the home loan. Pay you to definitely mortgage away from, along installment loans in Minnesota with an enjoyable income source. You will find an explanation that unnecessary most rich some one had the come from local rental property ownership.

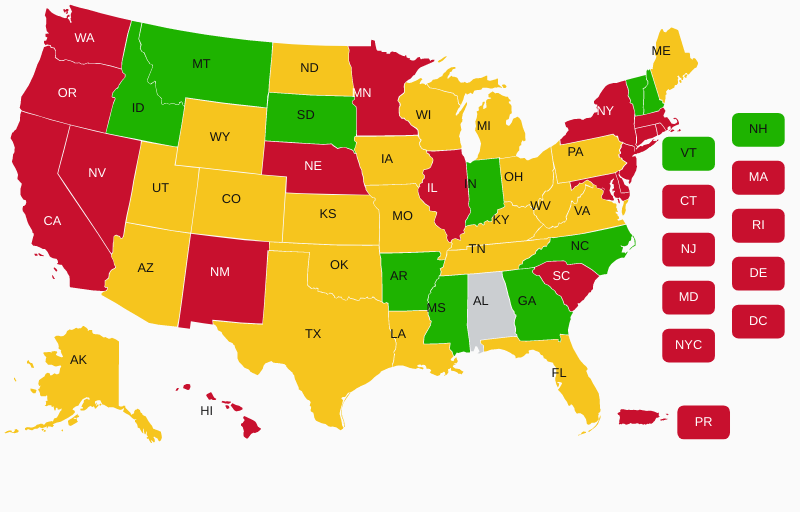

One of the greatest barriers to help you homeownership, according to many respected reports and you will studies, ‘s the deposit and you can domestic closing costs. But on the ninety per cent away from land in the us meet the criteria for the majority of type of advance payment advice (DPA) if for example the client qualifies. And financing instance Va mortgage loans and you can USDA lenders do not require one deposit.

You don’t need to feel an economic genius to get a good household. You don’t need to feel educated or steeped. But you have to want to buy sufficient, and you can station that want to your an idea, hence bundle towards action. Your own methods, perhaps not the studies, deliver the end result need.

Paying is the identical means. Consumers which have budgets inform you significantly more union and conserve better. Thus invest a month tracking every single thing you pay to own. Chances are high only attending to will cause one to save money. Should not song all of the cent? Then would a resources that have any of the many active on line equipment readily available.