Pattern day trading

It also has a great reputation. Suppose you decide to set up a paper trading account; you want to make sure that you prepare yourself to get the most information and experience possible out of the opportunity. PMS: INP000005786; Sharekhan Ltd. What distinguishes the scalper is that the intervals set for these indicators are very small. Generally, a trading account refers to a trader’s main account. A cup and handle is a technical analysis pattern that appears on a chart as a U shaped pattern, followed by a small downward drift, resembling a handle. Buy and sell these assets in real time, monitor your positions and analyse the markets. Image by Sabrina Jiang © Investopedia 2020. We are transferring you to our affiliated company Hantec Trader. Finance charges and other income are normally shown separately from administrative expenses. How can u describe that. Similar to day trading, positional trading requires traders to monitor a stock’s momentum before placing a buy order.

11 Most Essential Stock Chart Patterns

You can lose more funds than you deposit in a margin account. 250 for each referral. Users enjoy on the go access to their crypto portfolio, and the ability to https://po-app.site/ seize opportunities from anywhere, whenever they arise. Advanced traders may seek additional features such as margin trading, stop loss orders, and advanced charting tools. Chart patterns provide technical analysts with a visual representation of market psychology and potential support/resistance levels, allowing traders to identify trends, set triggers, and define risk/reward ratios for their trades. Mercedes Barba is a seasoned editorial leader and video producer, with an Emmy nomination to her credit. Compatibility – The indicator should work well with your trading platform and other tools you use. However, with the introduction of electronic trading, the open outcry system was replaced by trading accounts, which traders can use to buy and sell securities electronically without being physically present on the trading floor. The actual numbers of levels, and the specific options strategies permitted at each level, vary between brokers. By adopting a trend following strategy and meticulously planning entry and exit points, position traders aim to maximise profits over extended periods.

NSE Holidays 2024

It’s important to fully understand how they work and assess if you can afford the associated risks before investing. However, if the market share price is more than the strike price at expiry, the seller of the option must sell the shares to an option buyer at that lower strike price. Lewis was already a successful futures pit trader. App Store is a service mark of Apple Inc. For more up to date information, please contact us directly. English, Arabic, Czech, Danish, Dutch, Finnish, French, German, Italian, Norwegian Bokmål, Polish, Portuguese, Romanian, Russian, Simplified Chinese, Spanish, Swedish, Traditional Chinese, Vietnamese. With brokers like Bajaj Broking, it can be done in a matter of minutes. Scalping is a trading strategy where profits and losses are taken quickly, as trades typically last a few minutes or less. A study titled “Evaluating Short Term Trading Strategies on Intraday Time Scales: A Comparison of Candlestick Techniques on the SandP 500” published by Sahin and Akpinar reported that a 5 minute candlestick pattern strategy achieved an average annual return of 11. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. As subject to the provisions of SEBI Circular CIR/MRD/DP/54/2017 dated June 13, 2017, and the terms and conditions mentioned in the lights and obligations statement issued by the TM if applicable. In addition, Robinhood’s 1% match should appeal to investors looking to open a retirement account. The more details you provide, the faster and more thorough reply you’ll receive. Success mantra: This type of stock trading works well when the stock is either rising or falling and is ineffective during sideways movements. And you can begin your short term trading journey with as little as $500. A Demat account keeps a record of the digital shares held by you, but it is not meant for the actual trading or to buy and sell stocks. This provides a more detailed view of market activity, especially during periods of high trading volume. The model starts with a binomial tree of discrete future possible underlying stock prices. Our registered office is Level 17, 123 Pitt Street, Sydney, NSW 2000, Australia. Implied volatility is one of the most important concepts for options traders to understand because it can help you determine the likelihood of a stock reaching a specific price by a certain time. Of any of the Rules, Regulations, Bye laws of the Stock Exchange, Mumbai, SEBI Act or any other laws in force from time to time. It models the dynamics of the option’s theoretical value for discrete time intervals over the option’s life. Even more seasoned traders may benefit from a virtual experience.

1 Choose a Trusted Color Trading App

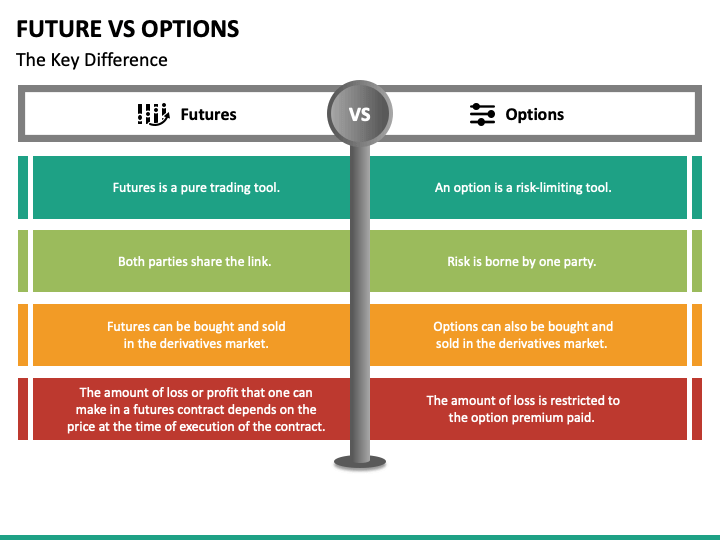

Option Trading is a broader term used in the investment sector, just like equity, commodity, currency, etc. By the 90s, algorithmic systems were becoming more common and hedge fund managers were beginning to embrace quant methodologies. Insider screener tracks more markets than comparable platforms, allowing you to uncover investment opportunities in overlooked markets. Sound position sizing and diversification are also essential to mitigate the risk of gaps, ensuring that traders do not put too much capital into a single trade. Yes, scalping is a high risk high reward trading style. But if you try to push the wave out when it’s coming in, it’ll never happen. Additionally, market conditions can change quickly, so traders must reconstruct their strategies accordingly. A ratio of 1 is considered a healthy number, but the number is not absolute and more insights could be gained if you compare it with that of other companies. Stocks poised for a significant move become a target.

Trade Every Market in One Place

Trading based on the news is one popular technique. Plus, you risk margin calls and securities liquidation as a day trader with a margin account. Here’s how you can trade online. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. Another way to add scalping to longer time frame trades is through the “umbrella” concept. Equity, Mutual Funds, Initial Public Offer IPO, Exchange Traded Funds ETF Index and Gold, Bonds, Non Convertible Debentures NCDIt would help if you also looked for the right tools to assist you in your intraday trading activities. Any references to past performance and forecasts are not reliable indicators of future results. VT Markets is duly licensed and authorised to offer the services and financial derivative products listed on the website. No need to issue cheques by investors while subscribing to IPO. Thus, you should also consider your finances, ability to commit time to options trading, and your emotional discipline.

Sign Up

Knowledge of the stock market in great detail is required for any trading technique in order to minimize financial losses. The Knowledge Academy’s 1 day Day Trading Course is designed to provide delegates with a thorough understanding of Day Trading strategies and market analysis. We take data security and privacy very seriously. You can trade CFDs on a huge range of assets, such as stocks, ETFs, indices and currencies foreign exchange. Volatility is back in the market, and as an option seller, you couldn’t ask anything better than this from the market environment. Sometimes stocks move a little more again after the NYSE lunch hour 1pm EST. Also, BFL shall have full rights to decide the commercial terms for IPO and final application and financing shall be subject to all requirements being met by the client in a timely manner including documentation, account setup and payment of required Interest and Margin. Our website will notify you if any of the other latest versions of this app are available. Develop and improve services. Sensibull is a comprehensive options trading platform that offers a user friendly interface and a suite of tools designed to enhance the trading experience for both beginners and seasoned traders. Tweak it further to increase the success rate even more. In our comparison guide between swing trading and investing, you learned that the main difference between these strategies is the holding period. And one of the ways to learn is from those that trade themselves.

Disclaimer

You can download and install it for free. Exchange based futures and options products and services are offered solely through the FCM division of SFI. Religare Broking LimitedRBL : Research Analyst SEBI Regi. The answer to what is a trading ac is that it an interface to trade in stocks besides being a bridge between an investor’s Demat and bank accounts. Update your mobilenumbers/email IDs with your stock brokers. Here, we’ll run you through some of the top position trading strategies and show you how to trade. No telephone number, no real support on such a basic level. Most stock trading apps allow you to start trading shortly after signing up and funding your account. However, you must understand the wash sale rule while gaining income tax deduction. Beginners also need reliable educational content and tips throughout the sites. Of algo strategies you can deploy. The path of least resistance is obviously downward from then on. Note that it is not advisable to place more than three trades containing one asset. Bajaj Financial Securities Limited or its associates may have received compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months. All times are Eastern Time.

Frequently asked questions

Hence, forex, commodities and some actively traded socks are best suited for swing trading. Platform experience: awesomeDevice options: website, tablet and phone appSupport: 24/5Stocks and Shares ISA: noPension SIPP: noRange of investments: largeStocks: yesETFs: yesFractional shares: noCrypto: yes not UKCFDs: yesForex: yesAccount fee: freeCost per trade: freeSpread fees: yes lowCurrency conversion fee: 0. This is particularly for beginners who have not done scalping before. A contract expires worthless when the price of the underlying security or index remains below in the case of a call or above in the case of a put the strike price. 30 days brokerage free tradingFree Personal Trading Advisor. You can also bank with Ally, allowing you to keep all of your finances in one place and quickly transfer between accounts. The one who receives the premium of the option and thus is obliged to sell/buy the asset if the buyer of the option exercises it. Best Loser Wins’ by Tom Hougaard presents a counterintuitive yet profound approach to trading, emphasizing the skill of managing losses effectively.

How many types of chart patterns are there?

Stock trading requires funding a brokerage account. Additionally, you should continuously educate yourself, stay updated on market trends, and adapt your strategies to changing market conditions. How to find the bid vs. The issuer has the corresponding obligation to fulfill the transaction to sell or buy if the holder “exercises” the option. There are a number of risks associated with trading. Following the trend is different from being ‘bullish or bearish’. Some ETPs carry additional risks depending on how they’re structured, investors should ensure they familiarise themselves with the differences before investing. Use profiles to select personalised content. In addition to its Jack Bogle created index funds, the brokerage offers commission free trading on several investments, automated investing through Vanguard Digital Advisor with the additional choice of one on one advisor guidance, thanks to Vanguard Personal Advisor, IRAs and other retirement resources, and market research and educational resources. Stock Market Trading immensely conceptualizes analyzing different charts and then making decisions based on indicators and patterns. An overbought signal suggests that short term gains may be reaching a point of maturity and assets may be in for a price correction. To read full story, subscribe to ET Prime. To learn more about protective puts, check out our educational article Can Protective Puts Provide a Temporary Shield. These require each user to divulge their identity, much as you would when you apply for a bank account, to combat money laundering and fraud. The investment strategies mentioned here may not be suitable for everyone. Analysts and traders describe any price changes with ticks. You can open a tastyfx forex account in minutes, and there’s no obligation to add funds until you want to place a trade. Overemphasizing Past Performance. A full featured broker with an excellent mobile trading app to complement its desktop platform. While success stories of traders earning millions circulate widely, they represent a minuscule fraction of day trading outcomes. Don’t believe the “forex is a $7. We are also the only provider to offer weekend trading on certain currency pairs, including weekend GBP/USD, EUR/USD and USD/JPY.

What is index trading?

The extent of this feature reduction has been lessened as the smartphone technology running these trading apps has improved, however, and more brokers are aligning and synchronizing key features across both the mobile and desktop workflows such as analysis, research, screening tools, money movement, and charting. Overview: Big Mumbai offers a solid platform with a focus on straightforward color prediction and hassle free withdrawals. We believe in supporting our traders in every step of the way. Cryptocurrency bot trading involves substantial risks, and past performance is not indicative of future results. Down market should be good for breakdown shortsellersThe others should be good for pullback buyers. Approximate measure of the underlying value of derivatives. VWAP bands, which are multiples of the standard deviation of VWAP, are used to identify potential support and resistance levels. It is better to opt for lower risk reward ratios for a higher win rate. Much like Saxo’s fantastic SaxoTraderGO platform suite, the look and feel of the CMC Markets mobile app closely resembles the web based version of the Next Generation platform. The greatest proportion of all trades worldwide during 1987 were within the United Kingdom slightly over one quarter. Prepare Trading Account and Profit and Loss Account for the year 31st March 2019. This strategy involves taking positions based on the impact of economic releases, company announcements, government policies, or geopolitical developments on financial markets. Allows instant investing. No human would be capable of doing this manually, so HFT firms rely on quant traders to build strategies to do it for them. We’re available 24/7 between 8am Saturday and 10pm Friday. If clients elect to exclude one or more Program Banks from receiving deposits the amount of FDIC insurance available through Cash Reserve may be lower. We use cookies to give you the best experience. Access our full range of markets, trading tools and features. Commodity markets trade raw materials and agricultural products. Create profiles to personalise content.

A/C opening Charges

A cryptocurrency wallet is an important tool for managing and storing your digital assets. They can help you identify when smart money is stepping in, smooth out price movements during pre market and after hours trading, and reduce noise in the data. The agricultural revolution. This partnership lasted until 2014, when Intercontinental Exchange ICE acquired NYSE Euronext and subsequently spun off Euronext as an independent entity. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The account opening process will be carried out on Vested platform and Bajaj Financial Securities Limited will not have any role in it. During the first 15 seconds, it trades below the opening price. Stop loss is a discipline; so, don’t try to second guess it. Advanced trading platforms tend to have many moving parts. These trading strategies could be the basis of developing your trading edge. These levels are often psychological. For example, the likes of eToro, IG, and Plus500 all hold licenses with the UK’s Financial Conduct Authority FCA and the Australian Securities and Investments Commission ASIC. And everyone seems to be passing the Buck without giving a straight answer. Step 1: Develop a Business Plan. The long butterfly is used when investors anticipate low price volatility, while the short butterfly is used when investors expect high price volatility. Expect to lose money a lot in the early days of trading, and always stick to the right trading size for your total portfolio bankroll. A company borrowing an amount larger than its equity is referred to as ‘trading on thin equity’. Before embarking on your FandO journey you need to first understand how to trade in futures and options. The net option premium for this straddle is $10. File a complaint about fraud or unfair practices. Internships positions also available: Apply here. This is also the point at which a quant will decide how frequently the system will trade. This includes some essential cookies. Please read the options disclosure document titled “Characteristics and Risks of Standardized Options. 91 Club features skill based games and multiple reward levels, including daily check ins and deposit bonuses. Most importantly, ensure the platform is regulated by a reputable authority to guarantee your funds’ safety. Margin loan rates for small investors generally range from as low as 6 percent to more than 13 percent, depending on the broker.

Buy or deposit crypto

The types of options trades you can place depend on your specific options approval level, which is based on a number of your personal suitability factors. 7 Use of Moving average convergence Divergence MACD in technical analysis. You will find many quizzes here that you must solve by yourself. Investors may also be turned off by the fact that Public requires users to manually opt out of tipping on each transaction, which the company calls “a more transparent, more aligned way to make money” than PFOF. Initial profit targets are set at the size of the island formation projected in the direction of the breakout. Much like Saxo’s fantastic SaxoTraderGO platform suite, the look and feel of the CMC Markets mobile app closely resembles the web based version of the Next Generation platform. You can read more about our editorial guidelines and the investing methodology for the ratings below. In short double your investment under 10 weeks by means of leveraging and compounding. Why you can trust StockBrokers. CMC Markets UK Plc and CMC Spreadbet plc are registered in the Register of Companies of the Financial Conduct Authority under registration numbers 173730 and 170627. In deciding what to buy—a stock, say—a typical day trader looks for three things. Moneybhai, offered by Moneycontrol, is a widely recognized paper trading app in India. Economic reports and corporate earnings releases are examples of scheduled news events that swing traders can prepare for in advance, adjusting their strategies to capitalize on or hedge against anticipated market reactions. Traders who employ scalping strategies are referred to as scalpers, and they typically make numerous trades within a single day. A stroke of bad luck can sink even the most experienced day trader. While chart patterns can be helpful signals, they only show what has happened in the past and do not guarantee future trends. Credit card products are offered by Robinhood Credit, Inc. The very best way to get into trading is to find a platform you trust, learn as much as you can about trading beforehand and then practise to get your skill, technique and strategies right. Tuition includes hands on training, a free retake, and a course manual. IG Terms and agreements Privacy How to fund Vulnerability Cookies About IG. Enter your email to subscribe to more articles about Investing. Learn more about our services for non U.

Trading

One of the benefits is the opportunity to place tight stop loss orders, which refers to increasing a stop price to limit the amount of money lost on a long position. Our registered office is CT House, Office 6B, Providence, Mahe, Seychelles. When it makes a lower swing low, this is a warning sign. The following are the key participants in the options market. Pipe tops and bottoms tend to be short term patterns that sometimes complete in 1 4 weeks. Invest in the world’s biggest companies for as low as ₹1. There’s no need to cannonball into the deep end with any position. Available in Apple App Store and Google Play. If it fails, you have probably created a curve fit strategy. Pilot Trader makes it easy for you to put your trading skills to the test in a lifelike simulated trading environment that mimics real market conditions while subtly selling you on their trading signals. If you are just getting started, educational materials and training could be quite useful. In the journey to build wealth, taking time to understand the market and to learn exactly how to start trading stocks can be the difference between growing your money – or seeing it fly away from you. You may also want to know about the share market holidays 2024 BSE Holiday List 2024. Vantage International Group Limited trading under Vantage, is authorised and regulated by the Cayman Islands Monetary Authority CIMA, Securities Investment Business Law SIBL number 1383491. This message is not intended as an offer or publication or solicitation for distribution for subscription of or purchase or sale of any securities or financial instruments to anyone in whose jurisdiction such subscription etc. Investors tend to be more concerned about long term factors that will affect the long term price of the stock, while traders tend to be concerned about short term movements in an hour, a day, or few weeks from now. CoinMarketCap was acquired by Binance Capital Management in April 2020. It can also be used fraudulently, however, as has been noted by the U. Retirement planning tools. Each type of intraday trading requires a different approach and skill set. Last Updated on September 3, 2023. Also, in this type of trading, the brokerage should be nominal. Delta will approach 1, or 1, for a call or put option, respectively, if it’s near expiration and in the money, while it will approach 0 for contracts that are out of the money as expiration nears. Thus, any claim or dispute relating to such investment or enforcement of any agreement/contract /claim will not be under laws and regulations of the recognized stock exchanges and investor protection under Indian Securities Law.