Government-backed

This permits lenders as so much more easy employing conditions and you may extend fund so you’re able to individuals just who may well not or even qualify on account of a reduced credit rating or diminished earnings. The 3 most well known kind of regulators-recognized financing is actually FHA, USDA and Virtual assistant fund.

- FHA funds: Supported by the latest Government Casing Management, this type of money render off money as little as step three.5% to people with fico scores out of 580 or maybe more (otherwise 10% off having a get away from five hundred). That one is fantastic those with straight down credit scores whom don’t be eligible for a normal financing.

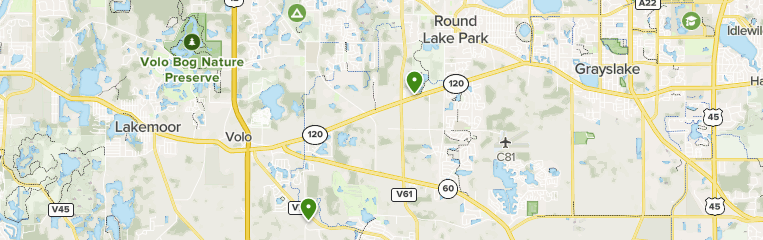

- USDA mortgage: Such funds is actually backed by brand new You.S. Agency off Farming and they are meant for reduced-money outlying People in america which can’t be eligible for a traditional financing. He has lower than-market interest levels for those who meet the requirements, in addition they do not require a down-payment. That it financing is a fantastic choice if you live in an excellent rural city and then have good credit.

- Va loan: Backed by the Agencies out-of Experts Affairs, Va money are especially getting experts otherwise energetic-obligations services users which satisfy eligibility criteria. In some instances, surviving partners may also qualify. Va fund will bring you to your property and no off commission as well as a reduced price.

State-work with software for first-day customers

Very claims have local software through local homes money firms so you can let earliest-day homebuyers. See just what downpayment help is in your area.

Such as, if you find yourself a california resident, you’ll be able to qualify for a ca Property Funds Agency (CalHFA) financing. Individuals inside Michigan will towards the Michigan State Houses Creativity Expert (MSHDA) getting advice about off costs and you can property training.

Contrast mortgage brokers

To purchase a home for the first time are an exciting, often daunting processes, however, you’ll find reputable loan providers and you can info that can assist. For every borrower has actually a little some other requirements that will modify the guidelines you take while the particular financing you go after. Do your homework and begin speaking with lenders to acquire one you become confident with.

Faq’s

Step one to getting home financing was determining just what variety of and you may sized mortgage you want. Following, you see a lender, that is a lender otherwise credit union or a specialist home loan company otherwise broker.

Once you have found a few an effective choice, score pre-licensed. Thus giving your an effective signal from exactly what loan words possible qualify for. From that point, you could officially apply. You’ll need to fill out various pieces of monetary and other documents, plus shell out stubs, tax returns and you may present bank comments (all pages, all the levels). Yet, their bank also focus on a challenging borrowing from the bank inquiry observe your credit score and you may background.

The preapproval letter is perfect for sixty so you’re able to ninety days. Have into the real estate agent. Now, you could potentially end up your property research and also make an offer. Should your provide are accepted, work on their broker to place down a deposit into the closing costs (also known as earnest money ).

Constantly, the lender will then agree the borrowed funds, set a closing go out and you may show how much money you are able to you want. Second, policy for their advance payment and you may closing costs become reduced – always through a lender wire otherwise cashier’s have a look installment loan Victoria at via an escrow account.

Before closure, you will find a home check, term research and assessment. Additionally, you will establish a people insurance. Depending on your area, you might also need locate flood insurance.

Fundamentally, arrive for the closure, remark the newest data directly, query any queries you really have, and you will, when in a position, indication the documents. Sooner or later, you will build your property tax and you may homeowners insurance money into the a keen escrow account.