Coverage is actually automatic after you discover one of these form of accounts in the a keen FDIC-insured lender. If you are in one of the 5.9 million You.S. homes instead a checking account, and you are clearly seeking to open an account, FDIC has info to aid get you off and running. Even though the the fresh signal have a tendency to stretch insurance rates for most believe owners, it might get rid of coverage when you have transferred over $step one.twenty five million for each and every owner within the faith account in the one to covered institution. Hence, i suggest which you take the time to opinion the believe membership plus faith and property thought documents understand how you will become impacted. If you feel the newest code will get impression your, delight call us to discuss your unique state much more breadth.

Have fun with IntraFi Community Dumps

In case your workplace does not give a great P60, you can use the fresh HM Revenue & Lifestyle app to obtain the same suggestions. A great P60 suggests simply how much tax you’ve got paid-in the fresh government’s financial year, and this https://gamblerzone.ca/genesis-casino-review/ works from six April so you can 5 April. For all those preparing to jet of on a break, i game up the study roaming charges are recharged because of the UK’s biggest cell phone organization. It isn’t obvious that will gain benefit from the You-change – the we all know is far more pensioners was qualified and you may an statement would be manufactured in the brand new fall.

June Game Fulfilling Plan 2025: All Showcase And ways to Check out

A negotiable Acquisition away from Detachment (NOW) membership try a cost savings put–maybe not a demand deposit account. Unincorporated connectivity usually covered less than this category were church buildings or any other religious organizations, community and civic teams and you will social clubs. The brand new FDIC assumes on that all co-owners’ shares is equivalent unless the new put membership facts state or even.

Of a lot brokerages also offer Dvds of other banks all over the country, so it is easy to remain within this FDIC constraints if you are potentially getting better cost. You need to be conscious you’re also responsible for ensuring that your bank account is dispersed certainly one of individually chartered banking companies to increase your FDIC insurance policies. Bank downfalls is impractical, however they manage happens. FDIC put insurance policies covers their covered places should your lender closes.

After that, for example cases is going to be placed directly under unexpected half a dozen-day name-as much as ensure that DCMWC might have been advised of all the circumstances/fee alter. Ahead of January step 1, 1957, some great benefits of the fresh FECA have been lengthened under particular things in order to reservists of one’s military in addition to their beneficiaries where injury or loss of the brand new reservist took place distinct duty while you are to your productive obligation. Public Law , acknowledged August 1, 1956, terminated the newest FECA entitlement these types of people productive January step one, 1957. A narrative page must also become composed for the claimant, with a copy for the DVA, outlining the brand new repayments, deductions, or type recuperation from twin costs.

Don’t stress, even when, as the 2nd-most-important thing to know about FDIC visibility is that you could be insured to get more, dependent on where you keep membership and exactly how he is had. One way to make sure all money is insured is always to bequeath they around the numerous associations. You instantly rating insurance policies to the newest $250,one hundred thousand limitation after you open an account in the a bank you to definitely’s FDIC covered. Understand how to ensure over $250,100. Financial institutions commonly insured by default.

What it way to provides FDIC insurance

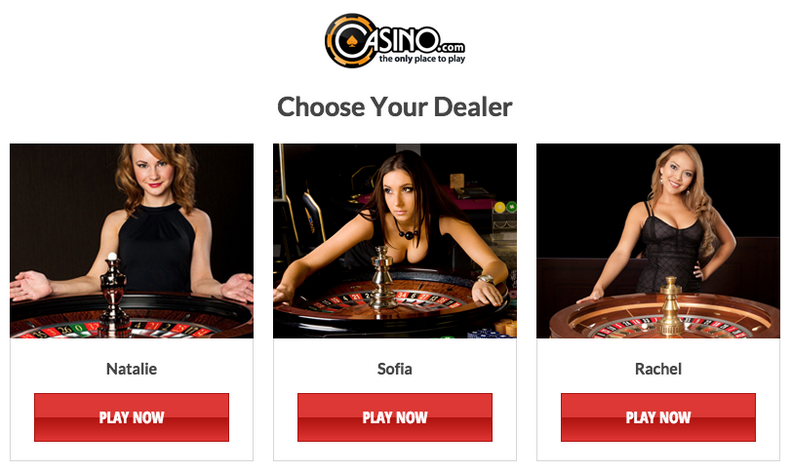

Users gamble by winning contests of possibility, in some cases which have a component of ability, for example craps, roulette, baccarat, blackjack, and you can electronic poker. Extremely games have mathematically computed chance you to guarantee the house provides constantly a bonus over the professionals. This really is indicated much more accurately by idea of asked well worth, which is evenly negative (regarding the player’s direction). It virtue is called our house border. Within the online game such as poker where professionals gamble up against both, our house requires a fee called the rake. Gambling enterprises possibly give out complimentary items or comps to help you bettors.

- The fresh T&We deposits is covered to the a “pass-through” base to your consumers.

- Although not, in practice, money inside disability claims are nearly always in line with the a week rates.

- It is sometimes identified as a lot of months of shell out, and other minutes as the a certain number of currency, depending on the legislation governing the newest agency in question.

- Of numerous brokerages provide Cds out of various other banking institutions across the country, making it an easy task to stay inside FDIC limitations when you’re probably making greatest rates.

- The new brokered class reasons such dumps to get deeper analysis from bodies through the bank analysis episodes and you will exposes the college to raised FDIC insurance premiums.

Name Away from Obligations Season 4 – All of the The brand new Black colored Ops 6 Multiplayer Charts, As well as Lover-Favourite Remaster

In the few almost every other times can it be expected otherwise liked by make a decision away from permanent and full disability. For example a choice confers no extra benefit to the claimant, and it you could end up forfeiture away from almost every other legal rights one a claimant get provides below other Government laws. Therefore, it certainly is sufficient to keep payments to possess temporary total disability (TTD), also in which perform in order to reemploy and you can/otherwise rehabilitate the brand new claimant failed.

So, somebody whoever accounts surpass the brand new restrict at the you to institution may wish to move a minumum of one account to another institutions so you can enhance their FDIC visibility. Today, there is certainly one to believe membership class complete with both revocable and irrevocable trusts, and you will a rely on holder provides you to definitely $step 1.25 million insurance coverage limitation for trusts. The entire signal one to a trust account get $250,100 of visibility per recipient are intact. A confidence account which have you to manager (the newest trustee) and you may three beneficiaries try covered to have $750,000. The most important thing to have account people to notice one to the put deal are to the unsuccessful financial which can be thought void abreast of the fresh failure of your own bank. The fresh obtaining business doesn’t have responsibility in order to maintain both the new unsuccessful bank prices otherwise terms of the brand new membership arrangement.