Posts

Go into the amount regarding the preprinted parentheses (while the an awful amount). The total amount of Mode 2555, range forty-five, might possibly be subtracted on the other amounts of income listed on contours 8a due to 8c and you can traces 8e due to 8z. Finish the International Attained Tax Worksheet for individuals who enter into an enthusiastic amount on the Mode 2555, range forty-five. You need to discovered a type 1099-Grams appearing inside her explanation container step 1 the entire jobless compensation paid back to help you your inside 2024. For many who operate a business otherwise practiced your own occupation while the a only proprietor, declaration your earnings and you can costs to the Agenda C. For many who gotten a questionnaire 1099-K to have an individual product which you ended up selling in the a gain, never declaration which number on the entryway space ahead out of Agenda step one; instead report it as you’ll statement some other funding acquire to the Mode 8949 and you will Agenda D.

Form of Dvds

In some cases, we might call you to address the inquiry, or charge a fee more information. Don’t attach interaction on the taxation go back except if the fresh communications refers to something to the return. Benefits made to which financing will be shared with the space Company for the Ageing Councils out of California (TACC) to incorporate advice on and you may support from Seniors items. If yes, attach a copy of the federal Setting 1040 otherwise 1040-SR come back as well as support government forms and you may times to make 540. 3rd party Designee – If you would like allow your preparer, a friend, partner, and other person you opt to discuss the 2024 taxation get back on the FTB, read the “Yes” box in the signature section of your taxation return.

You have zero certified returns from XYZ Corp. as you held the newest XYZ inventory at under 61 months. Should you get a great 2024 Mode 1099-INT to own You.S. deals thread interest detailed with number you claimed prior to 2024, come across Club. Don’t were attention gained in your IRA, wellness bank account, Archer otherwise Medicare Virtue MSA, otherwise Coverdell training family savings. When you are typing number that include cents, definitely range from the quantitative section. When you have to put a couple of number to find the quantity to enter for the a column, were cents when adding the brand new number and you will bullet from only the full. A registered home-based partner inside the Las vegas, nevada, Arizona, otherwise California need to generally statement half the new mutual community income out of anyone as well as their home-based mate.

When tend to my personal payments to be effective?

Offered the appropriate standards is came across, this will ensure it is one to claim an exemption on the attempting to sell a corporate to help you a member of staff cooperative. Budget advised tax laws so you can assists producing personnel possession trusts (EOTs). Such legislative proposals are currently ahead of Parliament in the Statement C-59.

Those who do not post the newest commission digitally might possibly be topic in order to a 1percent noncompliance penalty. California legislation adapts to federal laws enabling parents’ election in order to report a kid’s desire and you will bonus earnings away from children less than many years 19 otherwise an entire-day college student lower than decades twenty-four for the parent’s tax come back. If you wish to amend your own Ca resident taxation go back, complete an amended Mode 540 2EZ and check the package at the the top Setting 540 2EZ showing Amended come back. Install Plan X, California Cause from Amended Come back Changes, on the amended Setting 540 2EZ. For certain guidelines, discover “Tips to have Processing a 2024 Amended Get back”.

Failed to get the full very first and next money? Allege the new 2020 Recovery Rebate Borrowing from the bank

Attach an announcement number the newest week and you may season of the most other plans. Nothing of one’s reimburse is actually taxable when the, in the year you paid the fresh tax, you either (a) failed to itemize write-offs, otherwise (b) select so you can subtract condition and you may local standard sales fees rather than county and you may regional taxes. Where’s My personal Reimburse cannot song refunds that will be advertised for the an enthusiastic revised taxation go back. To check on the new status of your own reimburse, check out Internal revenue service.gov/Refunds otherwise make use of the 100 percent free IRS2Go software, round the clock, 7 days per week. Information about their refund will generally be available within 24 hours following Internal revenue service obtains your own elizabeth-recorded return otherwise 4 weeks after you mail a newspaper get back. But when you filed Form 8379 with your get back, allow it to be 14 days (11 weeks for individuals who registered digitally) before examining their reimburse reputation.

Simply because the fresh usually short-term nature of pupil residences as well as the unique GST/HST legislation one affect this type of organizations. These types of criteria is actually premised to your notion of a shared finance corporation becoming extensively held. Yet not, a company controlled by a business group can get meet the requirements because the a shared fund business while it is perhaps not widely stored. The money Tax Act boasts unique legislation for shared fund firms one to facilitate conduit treatment for buyers (shareholders). Such as, this type of legislation essentially make it financing gains know because of the a common money corporation as handled since the funding gains understood by their people. Simultaneously, a shared finance firm isn’t susceptible to draw-to-industry tax and can choose investment development therapy to the disposition from Canadian ties.

This would are one idea money you didn’t are accountable to your boss and you will one allocated information found in the field 8 in your Function(s) W-2 unless you can be that your particular unreported info is smaller compared to the count inside the field 8. Have the worth of any noncash information your gotten, including entry, passes, and other pieces of really worth. As you wear’t statement this type of noncash tips to your boss, you ought to statement him or her on the internet 1c. In the event the a shared get back, also include your spouse’s money of Mode(s) W-dos, container step one.

As the Form 2210 are challenging, you could potentially exit line 38 empty plus the Irs tend to contour the fresh punishment and give you a bill. We would not charge you desire on the punishment for those who pay by go out given on the expenses. You will find situations where the fresh Irs are unable to figure the punishment to possess you and you need to file Form 2210. In case your Different just explained cannot pertain, understand the Instructions for Function 2210 with other issues where you happen to be able to lower your punishment by the filing Setting 2210.

Finish the us government Pension Offset do boost monthly professionals inside the December 2025 because of the an average of 700 to possess 380,one hundred thousand readers delivering pros according to life partners, with respect to the CBO. The increase was on average 1,190 to own 390,000 otherwise thriving partners delivering a widow or widower benefit. These types of professionals will even develop throughout the years relative to Societal Security’s costs-of-life modifications. Alter will also apply to advantages from January 2024 forward, definition particular receiver will receive straight back-dated repayments. One of many eligibility conditions for an excellent GST Local rental Discount is that the tool is actually for enough time-name local rental.

Use tax has been doing impression in the Ca since the July step one, 1935. It applies to orders from presents for usage in the California from out-of-state suppliers and that is much like the conversion income tax paid back on the purchases you create inside the California. When you yourself have maybe not currently paid back all the fool around with taxation due to the fresh California Agency of Taxation and you may Payment Administration, you’re able to statement and pay the play with income tax owed in your state taxation go back. See the suggestions below plus the recommendations to possess Line twenty-six from your income income tax get back. Firefighters First Credit Connection provides legendary solution to help you firefighters as well as their family members across the country.

An increase to own lender places

Tend to my personal month-to-month Public Security percentage boost otherwise reduced amount of March 2025? Of several beneficiaries should expect a modest increase in monthly obligations due to the annual Cost-of-Life Changes (COLA). Yet not, certain higher-earnings readers could see quicker professionals otherwise enhanced taxation on their Public Defense income based on the the new earnings brackets. Although not, these transform include challenges, along with staffing incisions and also the healing out of overpaid advantages.

Make use of the Where’s My Amended Return software to the Irs.gov to trace the newest reputation of your revised go back. It will require around step three days regarding the time your sent they to show up in our system. You could file Form 1040-X digitally which have income tax filing app to amend Models 1040 and 1040-SR. Find Irs.gov/Filing/Amended-Return-Frequently-Asked-Concerns for more information. Area D—Explore in case your processing condition are Lead away from house. Essentially, somebody you only pay to prepare your come back have to sign it and you will is their Preparer Income tax Identification Matter (PTIN) from the area considering.

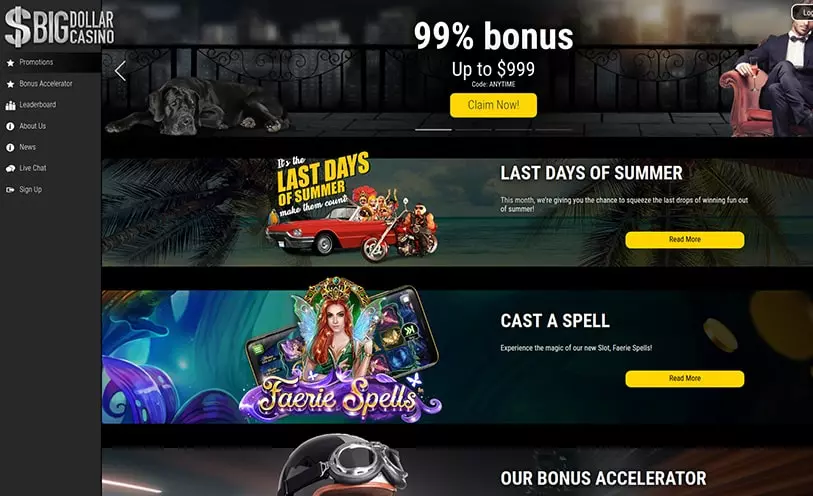

If you are using certain advertisement clogging application, excite consider their options. A deck intended to program the perform intended for taking the eyes from a less dangerous and more transparent online gambling globe so you can fact. 100 percent free professional instructional courses to possess on-line casino staff aimed at globe recommendations, improving player feel, and fair way of gaming.