Cryptocurrency market developments 2025

However, overall, a favorable turn in the broader environment (such as Fed rate cuts and balance sheet expansion) is still needed; and recent events such as the Ethereum Foundation selling tokens and core developers leaving have caused community dissatisfaction, coupled with the rise of competitors like Solana, may weaken the positive impact of the upgrade https://casinosus-games.com/. Although the testnet is progressing smoothly, if vulnerabilities or delays occur in the mainnet upgrade, it may trigger short-term selling pressure.

However, this positive factor may be partially offset by other macroeconomic factors (such as tariff policies), as Trump’s tariff policies could cause inflation. There’s a contradiction between inflation and rate cut expectations as the Fed maintains its forecast of two rate cuts (50 basis points) in 2025, but internal divisions among officials have intensified (fewer officials supporting cuts, more opposing). Meanwhile, core inflation expectations have been revised upward (2025 core PCE expectations raised from 2.5% to 2.8%), coupled with Trump’s tariff policies potentially pushing up import costs, inflationary pressures may limit the Fed’s room for rate cuts. If inflation remains persistently high, Bitcoin may face significant volatility.

In summary, if the Fed maintains a hawkish stance, US Treasury yields may continue to rise, and the crypto world may face sustained selling pressure; conversely, if economic data weakens or geopolitical risks ease, funds may flow back to risk assets like cryptocurrencies.

Cryptocurrency market analysis march 2025

The mixed signals across different cryptocurrencies suggest a complex market environment ahead. Investors should be prepared for volatility and consider diversifying their portfolios between digital and traditional assets.

According to a Monthly Market Insights report by Binance Research, the industry saw regulatory progress and growth in certain sectors in March, reinforcing positive sentiment for medium and long-term development.

Breaking above the Fibonacci level of $14.04 could signal a bullish reversal in $DOT, with significant growth potential. Support levels around $3.55 will be important for maintaining a positive trend.

DeFi platforms saw a drop in total value locked (TVL), from $177 billion in January to $128 billion in March. Meanwhile, NFT marketplaces experienced increased transaction volumes despite lower average sale prices. Institutional participation grew, with investment firms increasing their exposure to BTC and ETH.

Notably, meme coins saw negative growth, with the market cap of top tokens declining by millions of dollars. Since the launch of Official Trump (TRUMP), the meme coin launchpad Pump.fun has experienced a plunge in weekly usage metrics, including volume, token creation, and active wallets.

Best cryptocurrency to buy april 2025

To create supply, bitcoin rewards crypto miners with a set bitcoin amount. To be exact, 6.25 BTC is issued when a miner has successfully mined a single block. To keep the process in check, the rewards given for mining bitcoin are cut in half almost every four years.

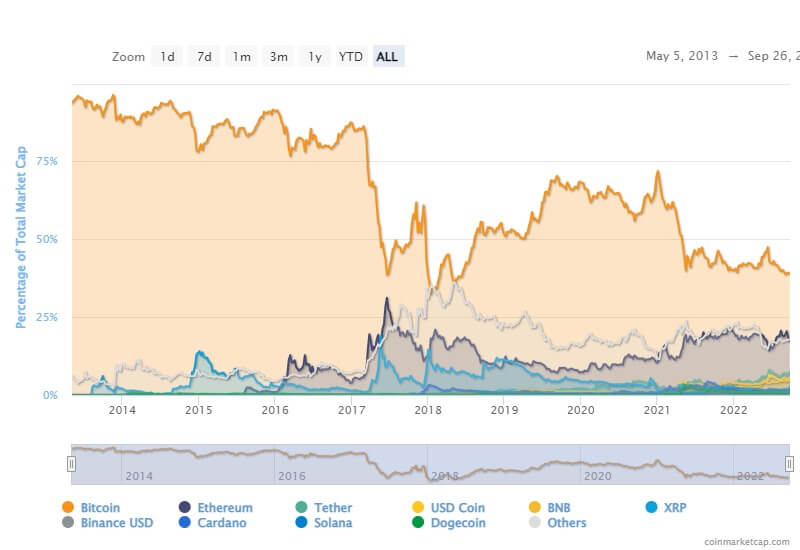

From bitcoin and Ethereum to Dogecoin and Tether, there are thousands of different cryptocurrencies, which can make it overwhelming when you’re first getting started in the world of crypto. To help you get your bearings, these are the top 10 cryptocurrencies to invest in based on their market capitalization or the total value of all the coins currently in circulation.

Created by some of the same founders as Ripple, a digital technology and payment processing company, XRP can be used on that network to facilitate exchanges of different currency types, including fiat currencies and other major cryptocurrencies.

XRP rebounded following Trump’s win and has since been on the watchlist of many investors. The good news is that it recently scored a major win after the SEC dropped its lawsuit against unregistered securities. This alone has made XRP an attractive investment, as banks and payment providers can now explore XRP’s fast, low-cost transaction capabilities without the fear of legal repercussions.

Unlike some other forms of cryptocurrency, Tether (USDT) is a stablecoin, meaning it’s backed by fiat currencies like U.S. dollars and the Euro and hypothetically keeps a value equal to one of those denominations. In theory, this means Tether’s value is supposed to be more consistent than other cryptocurrencies, and it’s favored by investors who are wary of the extreme volatility of other coins.

Artificial intelligence and community tokens represent 2025’s most powerful market narratives. MIND Of Pepe capitalizes on both trends by combining the viral appeal of the internet’s most recognized froggy character with practical AI applications.