Get the best fixed rates mortgage loans in Ireland playing with our very own contrasting. Lookup from the worth of, home loan and you may installment label into low interest rates.

Most recent Financial rates

When the ECB speed change, your own bank can increase otherwise decrease your mortgage rate if you find yourself toward a changeable rate, but is below zero duty to achieve this. Those towards tracker mortgages may feel the fresh new effect off changes quickly.

What’s a predetermined rates mortgage?

Repaired rates words generally speaking last for between one to and 10 years, however you can have one for twenty five years. Very lenders will give a range of repaired rates you can pick the word you to definitely best suits your position.

Fixed rates mortgages change from changeable speed mortgage loans, the spot where the interest and your month-to-month installment vary from the financial title.

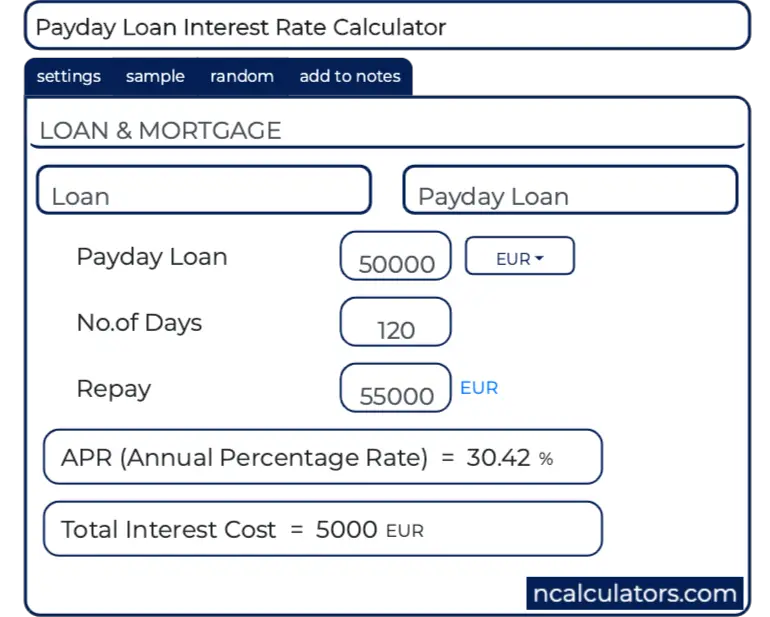

Lenders are required to quote the brand new Apr off Costs (APRC) when adverts a borrowing from the bank speed. The purpose is always to help you compare the real cost of credit.

Such as, a two seasons fixed rates financial that have an introductory rate of step one.99% and a booking payment of 999 one reverts on the lender’s fundamental variable rate (SVR) away from cuatro.19% for the next 23 ages ends up that have an APRC regarding step 3.7%.

For the present release of longer term fixed rates, such mortgage could be described as a couple of distinct particular home loan.

- Short-term fixed rates mortgages

- Lifestyle repaired rates mortgage loans

Extremely loan providers render temporary repaired rate mortgage loans to have between you to definitely and seven age. not numerous loan providers bring ten year repaired price mortgages and another even offers lifetime’ mortgages doing thirty years.

If for example the repaired rates home loan stops, the lending company usually revert the loan in order to a standard Varying Price (SVR) if you do not change to a special real estate loan.

Have there been costs for many who switch to a predetermined price?

While you are into the a variable rate mortgage, you aren’t locked with the a package to switch of course, if you adore.

But not, whenever you are tied in the repaired rates package and key ahead of your own fixed label comes to an end you’ll have to pay an early on cost fees (ERC), which will be pricey. Consult your bank ahead of altering.

Once your title has actually done, possible switch to the fresh lender’s simple variable price (SVR), and can option the mortgage in the place of punishment.

What takes place in the event your fixed price mortgage stops?

- overpay your financial around you adore

- redeem your mortgage and you can pay-off new an excellent harmony

- switch loan providers

Are fixed speed mortgage loans less expensive than changeable rates mortgage loans?

As interest levels stay sky-higher across the board, some fixed mortgages feel the lower costs readily available right now. A predetermined rate has the benefit of peace of mind during the turbulent times as well.

Numbers regarding the Main Lender out-of Ireland tell you more 80% of new mortgage loans into the Ireland are in reality repaired, because the homeowners get a hold of balance in the course of ascending costs.

Which have including an improvement between the reasonable and you may large repaired speed on the market, you might however save tens of thousands of euros for folks who switch immediately following your fixed rate identity stops.

How to pick the proper repaired speed home loan

The soundness of a permanent fixed rates financing excellent for budgeting, however, if rates of interest get rid of, you could be caught toward increased interest rate. Account for your financial attitude and the odds of appeal rates changing.

- Financial balance: When your profit was extended otherwise unstable, you may also choose a lengthier fix for assurance.

- Future plans: You can’t button or receive your own mortgage in the fixed name without having to pay a hefty penalty, so if a house disperse is found on new notes, a smaller name may help you avoid using very early redemption charge.

- Capacity to overpay: Fixed price purchases maximum simply how much you could potentially overpay at no cost (constantly ten% a year) till the term closes. Whenever you are saving to overpay which have a lump sum payment, select an expression one to concludes when the funds are ready, in order to overpay your mortgage in place of punishment.

Previously, might typically shell out a reduced interest rate on an initial repaired label and a high rate if you wish to correct it for longer. Yet not, due to present rate of interest increases on the Eu Main Bank, this isn’t necessarily the case.

There are several factors to think about. Like, that have lower, a few season fixed rates you will have to reason for the expenses of altering your home loan. Simply because you’ll need to remortgage more often that have a beneficial quicker repaired term loan.

At exactly the same time, for many who choose a longer repaired rates and you will rates of interest drop using your fixed months, you may not manage to key and take advantageous asset of good minimal package when you are tied from inside the.

Approaches for finding the best repaired rate financial

Use our mortgage research to find the best pricing thereby applying directly to the lender otherwise through a mortgage broker.

- Get an updated valuation and determine the loan in order to really worth (LTV)

What are the results online personal loans New Jersey second?

Once you’ve discover best financial offer, first-time buyers, financial switchers and house movers will need to apply to new lender to own home financing recognition the theory is that.

An endorsement in principle (AIP), is a page from a lender demonstrating the total amount they might give your based on specific very first monitors. Its absolve to score an enthusiastic AIP, and generally appropriate for half dozen or 12 months.