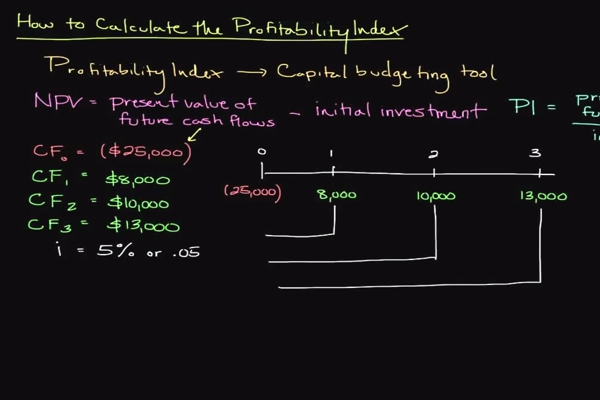

But, the profitability index can get calculated using the following profitability index formula(s). Profitability Index is a reliable financial analysis technique to foresee if an investment project will prove financially feasible, or not. It means that this investment will bring you a 56% return over the initial investment. Step 4) Hit Enter to have the present value of the given cash flows calculated. There are two functions that you can use to calculate the present value of these cash flows. PI and Net Present Value (NPV) are two financial tools that are widely used as a profit estimation metric for businesses.

How to Manually Calculate the Profitability Index

The Profitability Index offers a quantitative lens through which we can view the likely success of a prospective investment. With PI, we can sift through a multitude of possibilities and prioritize projects that promise the highest returns relative to their costs. It’s especially useful in situations where capital is scarce and must be allocated efficiently.

How to Calculate Profit with Profitability Index Excel Formula

And this gets done by measuring the ratio between the initial capital investment and the present value of future cash flows. This index compares the present value of future cash flows to the initial investment, reflecting the efficiency and profitability of a project. Profitability index (PI) is the ratio of present value of a project’s expected future cash flow and initial investment needed to undertake the project. It helps companies and investors measure the expected return for each dollar invested into a project or venture. Other names used for profitability index are the value investment ratio (VIR) and the profit investment ratio (PIR). The profitability index can also get referred to as a profit investment ratio (PIR) or a value investment ratio (VIR).

Profitability Index vs NPV

Often overshadowed by its more famous cousins like Net Present Value (NPV) and Internal Rate of Return (IRR), PI offers a unique perspective in investment decision-making. It tells us the bang for the buck, the value you get for every unit of currency invested. In essence, PI helps in determining the desirability of an investment. The NPV @ 14% in last column of the above table has been obtained by subtracting the initial investment at C0 date from the present value @ 14% discount rate. The numerator is the present value of cash flow that occurs after the initial funds have been invested into the project. The denominator consists of the total funds the firm initially needs to undertake the opportunity.

- Always ensure that figures are accurate and that the formulas are correctly entered, as even minor mistakes can lead to large discrepancies in financial analysis.

- As they are considering whether it’s a good deal to invest in, they have found out that the present value of the future cash flow of this project is 130 million.

- Measuring the Profitability Index is not just a financial formality; it’s a crucial compass for navigating the potentially stormy seas of business investment.

Net present value means the present value of an investment after deducting the cost of investment from it. For the example we discussed above, it would be $1124 ($3124 – $2000). For the example discussed in the above section, we would have yielded a PI of 1 if the present value of cashflows was $2000. The profitability index however can not be a negative number, it can be less than 1 or greater than 1. To neutralize the results in such a situation, you can prefix the PI formula with a minus sign. Step 3) Next, refer to the cell range containing the cashflows to be discounted as the next argument.

Comparative Analysis

Let’s take a look at some examples of PI calculations to help you understand how it works. If you don’t fancy calculating the present value manually, you can use the present value calculator here.

By leveraging the calculator’s insights, investors can make data-driven decisions, reducing reliance on subjective assessments and increasing the accuracy of their investment evaluations. Internal rate of return (IRR) is also used to determine if a new project or initiative should be undertaken. Broken down further, the net present value discounts after-tax cash flows of a potential project by the weighted average cost of capital (WACC).

However, there is another way through which we can express PI, and that is through net present value. NPV method is a good measure as well to consider whether any investment is profitable or not. Suppose further that the company has only $40,000 available to invest and all the projects are independent, not mutually exclusive. Because of cash constraint, It can’t undertake both project 1 and another from project 2 and 3.

The PI, known as the value investment ratio (VIR) or profit investment ratio (PIR), represents the relationship between the costs and benefits of a proposed project. You need to consider initial investment, the rate of return and future cash flows. The profitability index measures whether or not a project or investment will benefit your business.

For example, if a project costs $1,000 and will return $1,200, it’s a “go.” A helpful tip is to keep the layout of the spreadsheet clean and organized. This not only aids in the calculation process but also makes the data more comprehensible when revisiting the analysis or presenting what is an audit everything about the 3 types of audits it to stakeholders. There are two different calculations that you can use to determine the profitability index. It doesn’t matter the type of business that you operate or the industry that you are in. It also doesn’t matter if you’re a sole trader or a limited liability partnership.

It divides project capital cash inflows based on projected capital cash outflow. The concept of profitability index formula is very important from the point of view of project finance. It is a handy tool to use when one needs to decide whether to invest in a project or not. The index can be used for ranking project investment in terms of value created per unit of investment.