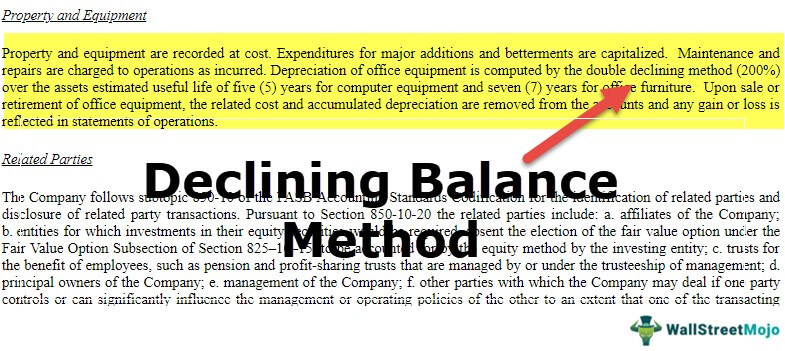

This GAA is depreciated under the 200% declining balance method with a 5-year recovery period and a half-year convention. Make & Sell did not claim the section 179 deduction on the machines and the machines did not qualify for a special depreciation allowance. The depreciation allowance for 2023 is $2,000 [($10,000 × 40% (0.40)) ÷ 2]. As of January 1, 2024, the depreciation reserve account is $2,000.

Free Double Declining Balance Depreciation Template (Calculator)

You can elect, for any class of property, not to deduct any special depreciation allowances for all property in such class placed in service during the tax year. You can elect to claim an 80% special depreciation allowance for the adjusted basis of certain specified plants (defined later) bearing fruits and nuts planted or grafted after December 31, 2022, and before January 1, 2024. The basis of a partnership’s section 179 property must be reduced by the section 179 deduction elected by the partnership. This reduction of basis must be made even if a partner cannot deduct all or part of the section 179 deduction allocated to that partner by the partnership because of the limits. For its tax year ending January 31, 2023, Oak Partnership’s taxable income from the active conduct of its business is $80,000, of which $70,000 was earned during 2022. John and James each include $40,000 (each partner’s entire share) of partnership taxable income in computing their business income limit for the 2023 tax year.

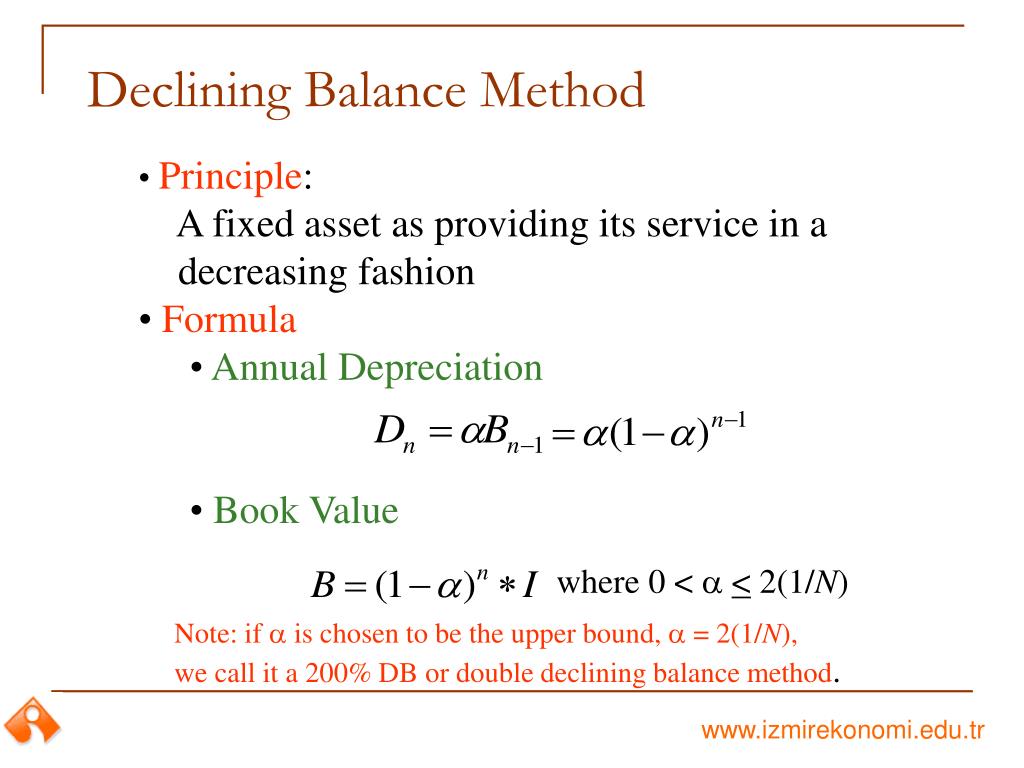

What is the 150% declining balance depreciation?

It also explains how you can elect to take a section 179 deduction, instead of depreciation deductions, for certain property and the additional rules for listed property. In this case, the management usually determines the depreciation rate in the declining balance method based on past experience as well as the type of business or industry and the manner that the fixed asset is used. The depreciation rate can vary based on the different types of fixed assets.

- Let’s assume that FitBuilders, a fictitious construction company, purchased a fixed asset worth $12,500 on Jan. 1, 2022.

- Instead, you can divide the expenses based on the total business use of the listed property.

- If you made this election, continue to use the same method and recovery period for that property.

- He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

- This election does not affect the amount of gain or loss recognized on the exchange or involuntary conversion.

Ask Any Financial Question

You use GDS, the SL method, and the mid-month convention to figure your depreciation. You figure the SL depreciation rate by dividing 1 by 4.5, the number of years remaining in the recovery period. (Based on the half-year convention, you used only half a year of the recovery period in the first year.) You multiply the reduced adjusted basis ($800) by the result (22.22%). You figure the depreciation rate under the SL method by dividing 1 by 5, the number of years in the recovery period. The result is 20%.You multiply the adjusted basis of the property ($1,000) by the 20% SL rate.

Salvage value in declining balance depreciation

To make an election, attach a statement to your return indicating what election you are making and the class of property for which you are making the election. For certain specified plants bearing fruits and nuts planted or grafted after December 31, 2023, and before January 1, 2025, you can elect to claim a 60% special depreciation allowance. To be qualified property, long production period property must meet the following requirements. In addition, figure taxable income without regard to any of the following.

For other listed property, allocate the property’s use on the basis of the most appropriate unit of time the property is actually used (rather than merely being available for use). The determination of this August 1 date is explained in the example illustrating the half-year convention under Using the Applicable Convention in a Short Tax Year, earlier. Tara is allowed 5 months of depreciation for the short tax year that consists of 10 months. The corporation first multiplies the basis ($1,000) by 40% (the declining balance rate) to get the depreciation for a full tax year of $400.

Current book value is the asset’s net value at the start of an accounting period. It’s calculated by deducting the accumulated depreciation from the cost of the fixed asset. For example, the depreciation expense for the second accounting year will be calculated by multiplying the depreciation rate (50%) by the carrying value of $1750 at the start of the year, times the time factor of 1.

Examples include a change in use resulting in a shorter recovery period and/or a more accelerated depreciation method or a change in use resulting in a longer recovery period and/or a less accelerated depreciation method. You also generally continue to use the longer recovery period and less accelerated depreciation method of the acquired property. You reduce the adjusted basis ($173) by the depreciation claimed in the fifth year ($115) to get the reduced adjusted basis of $58. There is less than 1 year remaining in the recovery period, so the SL depreciation rate for the sixth year is 100%. You multiply the reduced adjusted basis ($58) by 100% to arrive at the depreciation deduction for the sixth year ($58). Figure your depreciation deduction for the year you place the property in service by dividing the depreciation for a full year by 2.

At the end of 4 years the net book value is 1,296 which equals the salvage value of the asset. You are a sole proprietor and calendar year taxpayer who works as a sales representative in a large metropolitan area for a company that manufactures household products. For the first 3 weeks of each month, you occasionally used your own automobile for business travel within the metropolitan area. During these weeks, your business use of the automobile does not follow a consistent pattern. During the fourth week of each month, you delivered all business orders taken during the previous month. The business use of your automobile, as supported by adequate records, is 70% of its total use during that fourth week.

However, the amount of detail necessary to establish a business purpose depends on the facts and circumstances of each case. A written explanation of the business purpose will not be required if the purpose can be determined from the surrounding facts and circumstances. For example, a salesperson visiting customers on an starting a bookkeeping business established sales route will not normally need a written explanation of the business purpose of their travel. You do not have to record information in an account book, diary, or similar record if the information is already shown on the receipt. However, your records should back up your receipts in an orderly manner.

Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. This is important for accurate financial reporting and compliance with… The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Is a form of accelerated depreciation in which first-year depreciation is twice the amount of straight-line depreciation when a zero terminal disposal price is assumed.