When a tier dos visa try approaching their termination, a charge owner will have to get a talented worker visa so you’re able to offer their stay into the British.

The fresh charge system is an information-mainly based program that requires a candidate requiring 70 items to be qualified to receive an experienced employee visa.

This guide commonly speak about this new mortgage loans open to international nationals doing work in the uk around sometimes a level 2 visa or good competent doing work visa.

A common misconception would be the fact international nationals are unable to get a home loan with their visa standing this really is not the way it is. Mortgage lenders often determine a credit card applicatoin generally toward common credit monitors and you will value conditions.

But not, lenders is likewise trying to find along time the latest applicant provides lived inside the Uk and also the length of time left on their latest visa.

For each and every lender’s standards vary yet not typically lenders perform assume one financial apps will receive come a resident in the British a the least 2 yrs prior to a loan application so you can create a credit reputation in the Uk.

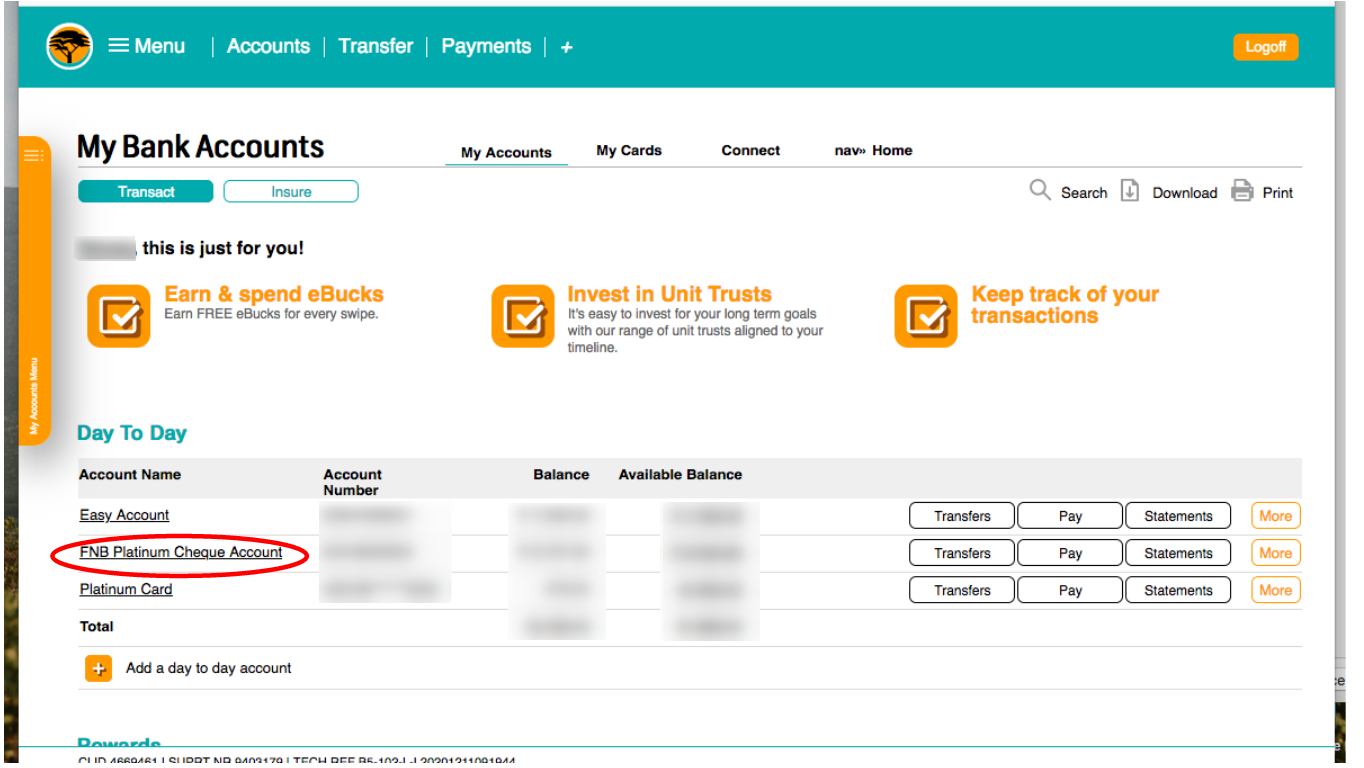

Specific lenders is a great deal more tight and can require an effective about three-year residency plus a beneficial Uk lender and family savings, but in come back, such loan providers may offer a lot more favourable terms and conditions.

Ought i Get a tier dos Charge otherwise Skilled Worker Visa Financial with a less than perfect credit History?

A track record of bad credit will get impact people home loan software not the level of influence depends upon the severity of the newest financial hardships.

Reputation for County Courtroom Judgments (CCJs), defaults, bankruptcy proceeding otherwise Private Volunteer Arrangements (IVAs) create represent an elevated chance to a lender than simply a minor offense.

But not, loan providers would-be trying to find the duration of big date who’s introduced since sleep credit matter was logged to your a keen applicant’s credit score.

Although it wouldn’t be impractical to see a mortgage with a poor credit history, merging it basis which have a charge-relevant standing could possibly get restrict the options.

Inside scenario, it would be imperative the candidate seeks independent monetary guidance before and then make a home loan application so that all almost every other individual situations come in probably the most confident reputation prior to addressing a loan provider.

An expert mentor may recommend hence lenders could be very suitable, get the best economic tool towards standards and you will gauge the probability of an application are recognized.

Financial Lender’s Factors When Determining a tier dos Charge or Competent Personnel Visa Mortgage Software

Just as in a simple financial app, lenders often take on an assessment way to feedback the whole personal and you can financial situation of your applicant(s) to produce a decision on lending.

- Ages Loan providers will receive a maximum age that they are happy to give to help you

- Lifetime of quarters in United kingdom Due to the fact talked about lenders are certain to get the absolute minimum requirement of just how long a software need to have resided into the British in advance of an software are made

- Timeframe from the most recent target

- Employment status and https://paydayloanalabama.com/autaugaville/ time which have an employer

- Level of dependants

- Value Lenders often for each possess their own cost requirements which include evaluating the degree of bills one an applicant provides and you can method of getting credit also monthly expenses and you may degrees of throwaway earnings

- Credit history & Credit score A lender carry out remark both a keen applicant’s latest credit rating once the well since the intricate credit history declaration along with information regarding records of the last borrowing such as for instance finance, playing cards, house expense and will malfunction the prosperity of regular payments given that really due to the fact outlining any late otherwise overlooked instalments and other things.

When there is any tall incidents towards the a credit score including because State Courtroom Judgments (CCJs), non-payments, bankruptcy otherwise Personal Voluntary Preparations (IVAs) with respect to the circumstances, it may be better to hold back until the fresh events disappear a credit report once 6 ages.

When you yourself have a reputation these incidents, it is imperative you to definitely guidance try tried out-of sometimes an independent economic advisor or large financial company in advance of and then make home financing software who will determine all of the things inside it and you may recommend the chances of a loan application becoming accepted.

Overseas National Mortgages

Level 2 visas or Competent Staff member Visas are not the only form of immigration statuses that might be acceptable for home financing in britain. Other performs it permits or statuses is generally regarded as long as brand new candidate fits the second key conditions:

- Resided from inside the United kingdom to have at least a couple of years

- Provides a permanent employment offer set up

- Enjoys an open British family savings

Investing in possessions in order to book is actually a popular selection for of several nevertheless the requirements having Get-to-Help Mortgage loans is pretty rigid, commonly demanding high levels of places plus a corporate bundle detailing the latest forecast income demonstrating the possibility rental earnings.

There are not any limits for foreign nationals involved in the united kingdom not as much as possibly a level dos visa otherwise a talented performing visa, obtaining a purchase-to-Let Financial for as long as the brand new requirements shall be met.

As with other types of lending products, the financing requirements differ ranging from lenders which to own an insight into the marketplace criteria and you will regular financial enjoy, we recommend that an appointment is made with a home loan broker.

Tier dos Visa Mortgages Realization

Whenever you are a different federal trying to purchase a house in British, delight get in contact with the pro party off mortgage brokers. All of us get access to numerous loan providers and you will mortgage items in purchase to obtain the proper fits for the private items.

Take a moment in order to connect with this friendly team out of advisers in order to guide an initial visit to discuss your options out there.

Contact us today for the 03330 ninety sixty 30 or be sure to make contact with us. Our advisors might be ready to chat compliment of all of the alternatives to you.