Tx and you can Ca: The fresh At the-House Burial Exemptions

Before planning an outdoor graveyard as a means to cease possessions fees, you should understand county-specific guidelines out-of at-home burials.

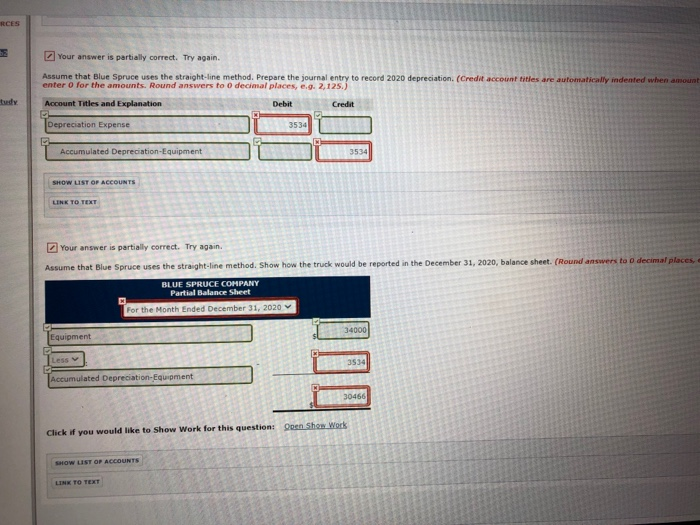

From inside the Tx, the Texas tax password claims: You’re eligible to an exception from tax of assets the guy possess and you can spends only for person burial and you will really does not hold having money.

It means if for example the property was only utilized just like the an excellent burial website and never getting money, it might qualify for a property tax difference. Yet not, while hoping one burying you to definitely relative in the lawn have a tendency to rather decrease your taxes, reconsider. The fresh new difference enforce only to properties put only for graveyards-meaning no dual-objective homesteads or amusement places allowed.

In comparison, California’s laws loans Hot Sulphur Springs CO and regulations is somewhat additional. The state states one to: A house that is located to have half dozen or higher human bodies hidden inside isnt eligible for the new exception to this rule unless its put otherwise stored simply for burial objectives once the described from inside the Possessions Income tax Code 132(a).

Including Tx, into the Ca, in the event a property have half a dozen or more authorities tucked into the it, you are able to overlook the new exception unless of course the home caters to zero other purpose. The fresh new code underscores the significance of uniqueness when it comes to so it creepy assets tax split.

And they are just a couple of states. With legislation one to change from state to state, qualifying because of it formal difference might be a difficult offer is to your actually ever intend to flow. Not to mention, troubled domiciles are more secret than just reduce throughout the real estate markets.

Well-known Assets Taxation Exemptions: An even more Simple Heart

Since thought of a backyard cemetery might be macabre, its unlikely most people will stumble on it specific niche tax state. Although not, there are many well-known exemptions accessible to lighten the newest income tax stream to have numerous types of home owners.

Brand new homestead difference is one of the most better-identified tax holiday breaks. This enables home owners to reduce the latest taxable worth of their priount it are obligated to pay in assets fees. The level of the latest exemption varies by state, but it’s usually a serious protecting. In Tx, with a few of the state’s large assets taxation, a professional standard household homestead can also be excused $100,000 on appraised property value their home to have college or university region fees. But not, a number of claims, particularly Nj-new jersey, do not have an excellent homestead difference.

Exactly what try an effective homestead? When you look at the tax conditions, a beneficial homestead is basically a holder-occupied primary household, therefore a beneficial homestead exception to this rule would not connect with second homes, people (except if simple fact is that exact same possessions in which one mostly life), otherwise rental systems.

Of several says render a difference getting assets taxation to old owners, allowing those individuals more a specific years (often 65) so you can claim additional write-offs. This type of write-offs may either freeze assets fees within a certain price otherwise clean out all of them completely, providing a serious save so you can older residents.

In lot of claims, land employed for agricultural intentions is discover a home income tax break. You can find other requirements so you can qualify for which exception to this rule depending on a state, however, getting so it taxation break essentially requires that an effective landowner take part into the pursuits like farming, ranching, bush manufacturing, otherwise livestock husbandry.

Veterans also can qualify for tax exemptions, especially if these were disabled throughout their service. The property income tax deduction and you can exemption to own peacetime experts is sometimes tied to the amount of impairment, with a few handicapped veterans receiving complete waivers from property fees.

Property Tax Concepts: Just how Is actually Possessions Taxation Calculated?

Prior to diving towards the exemptions, it’s important to understand how property taxes functions. Regional governing bodies gauge the value of a home then apply a tax price to that particular value, hence may vary based location. The method concerns appraisals and tests one to take into account the reasonable field value of property or home.

Immediately after a good property’s well worth try assessed, the government find who is exempt from paying assets tax based on the individuals circumstances, like the exemptions mentioned above. Knowing the research procedure may help homeowners advocate to have reasonable appraisals and take benefit of any exemptions wherein they might be considered.

Its smart having a good Servicer Having CoreLogic DigitalTax

In spite of the variety of exemptions accessible to home owners regarding You.S., we still have to spend property fees. As a result, comprehending that possessions taxation are paid off accurately as well as on-big date is important.

To possess residents working with servicers, comfort arises from knowing the taxes are increasingly being paid off promptly and you can truthfully. Equally important is left advised on taxation money. For this reason the country’s top 20 domestic servicers have confidence in CoreLogic. Indeed, our company is respected with more than 48 mil loans less than tax services when you find yourself dealing with twenty-two,000 You.S. taxing agencies.

Our sleek approach helps servicers make it easier to. Which have access to near-real-big date possessions tax analysis, i avoid exclusions regarding slipping through the splits so as that money are correctly determined and that you understand position of the fee each step of one’s method.