Extremely choices for home fix money can be secure, which means that there is a threat you can reduce your house, or simply provide reasonable prices to the people with good credit. Just like the credit would be high-risk and costly, you should know other available choices before you take away a home resolve mortgage. Should your resolve is not urgent, consider reevaluating your financial allowance to keep extra cash instead of borrowing from the bank. If it is an urgent situation, consider asking loved ones otherwise family relations to possess let; they more than likely won’t cost you high interest rates and can feel far more versatile with repayment. You might envision among the many following the solutions:

Cash-away re-finance

Cash-out refinancing makes you change your current home loan with good huge mortgage and continue maintaining the real difference since dollars. By enhancing the dominant, you’ll encounter a top monthly payment, however you will located a lump sum payment that one can lay on called for fixes. Brand new lump sum payment is typically only about 80% of your own residence’s available equity. It may be it is possible to to find a lesser interest rate when you refinance, however you will spend closing costs when you’re that it station.

Contrary mortgage

A face-to-face home loan try a way to own property owners years 62 and more mature to help you borrow secured Hamilton AL loans on the new security within their belongings. This is exactly recommended for anyone that currently paid its financial and desires to discovered repayments about lender for household solutions. You’ll shell out settlement costs and possibly even mortgage insurance premiums, but you’ll not need to pay off the borrowed funds if you do not promote your house otherwise die, and you can not need to spend taxes to the currency you will get.

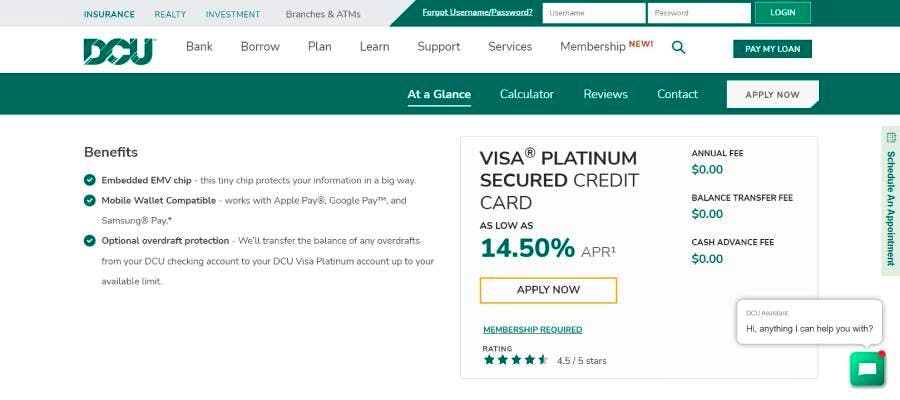

Handmade cards

When you yourself have a good credit score, you could be eligible for a credit card that have a 0% basic Annual percentage rate, in fact it is helpful for capital minor fixes that may be paid back for the desire-100 % free several months. Typically, you could potentially end attention to have 12 in order to 1 . 5 years with your notes. Getting more substantial repair that you should pay-off more time, you will probably be better of with an unsecured loan. That is because due to the fact introductory months ends, an average credit card , as the average Apr on the a personal loan means %.

HUD direction apps

Occasionally, low-money residents may be qualified to receive gives otherwise notice-free fund about Company regarding Houses and you can Urban Development. Verify if you find yourself eligible for local do-it-yourself software before you comparison shop to own home resolve fund.

How exactly to get ready for future solutions

Home solutions are unavoidable, and the best way to set up on debts is to remain a fully-stored crisis financing. You’ll have the homeowner’s allowable number stashed away within the addition to cash to own noncovered repairs. Pros basically suggest protecting step one% of house’s really worth for unanticipated repairs, but when you understand solutions which can be needed within the the long term, you should initiate saving now. Be mindful of the life of the appliances or other options that come with your property so you can become economically prepared.

Please be aware brand new lower than post includes website links so you’re able to exterior sites external of OppU and you can Opportunity Financial, LLC. These types of supplies, if you’re vetted, are not associated with OppU. For people who just click some of the website links you are delivered to an outward web site with different small print you to can vary away from OppU’s policies. We advice you do their search prior to getting into people goods and services down the page. OppU is not a topic matter professional, nor can it guess duty if you decide to engage some of these goods and services.