Financial advertising try a greatly regulated area of the economic functions markets. Simply, that is because home is the single most significant purchase that every people will ever before create.

Wider Controls

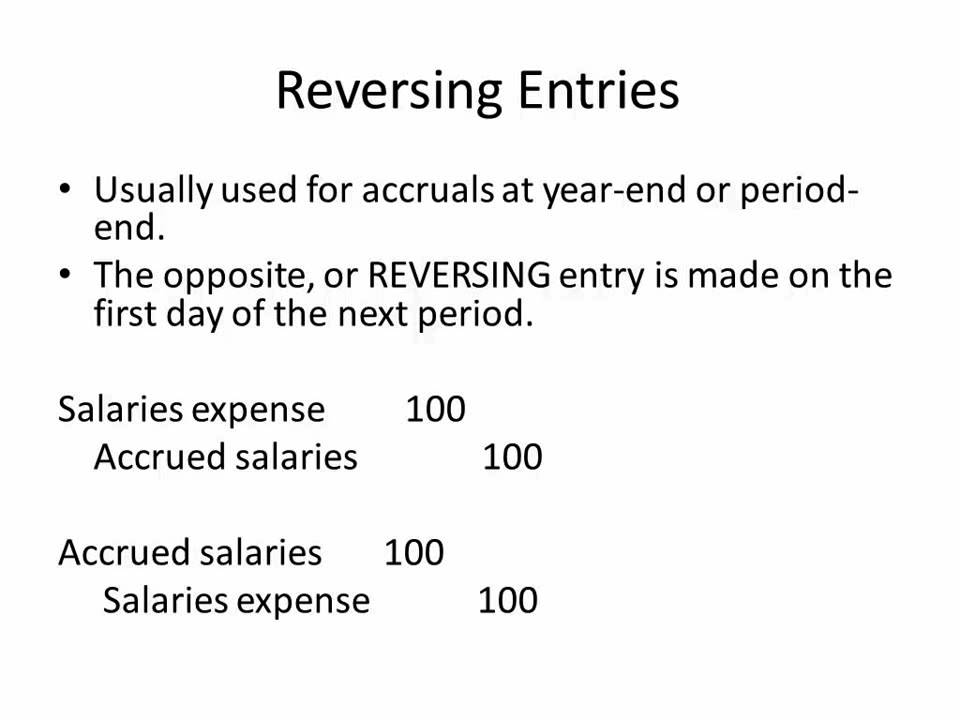

To avoid unscrupulous lenders out of taking advantage of borrowers, home loan advertisements is regulated because of the government rules. The very first ones laws and regulations may be the Mortgage Acts and you may Means Advertisements Signal (Charts Rule), the case during the Financing Operate (TILA), as well as the User Economic Safety Operate away from 2010.

The newest Maps Signal, labeled as Regulation Letter, regulation the way mortgage features total try stated, and also make inaccurate states illegal.

Certain FHA Contrary Mortgage Controls

Additionally, discover legislation that pertain specifically in order to contrary mortgages. A lot of reverse mortgage loans in the us is actually house guarantee conversion process mortgages (HECMs), which the Federal Property Administration (FHA) makes sure.

The brand new FHA regulates brand new advertising out of FHA-recognized finance features certain guidelines to possess reverse mortgage loans. Significantly less than FHA guidelines, loan providers must identify all of the criteria and features of your HECM program in obvious, consistent code to help you people.

Government rules per reverse financial ads try administered from the Government Exchange Commission (FTC) additionally the CFPB, all of having taken action up against of a lot lenders for incorrect claims of the opposite financial ads.

This new CFPB cravings earlier Americans to watch out for mistaken or complicated opposite financial adverts. Customers need to keep in your mind you to definitely an opposite mortgage was a great mortgage, you to definitely adverts is going to be mistaken, hence instead of a bundle, you can even outlive the bucks loaned.

County Regulations toward Opposite Financial Advertisements

Plus federal regulations, several states possess passed guidelines that limit the way in which reverse mortgages shall be advertised.

Any of these statutes, such as those into the Vermont and you can Tennessee, aim to subsequent restriction the art of contrary lenders to misrepresent exactly how these fund performs.

Someone else, for instance the regulations in essence for the Oregon, identify and need enough disclosures-very important bits of pointers that bank need certainly to discuss toward potential debtor-and you may indicate these should be common and not come throughout the small print.

A good amount of claims, unlike prohibiting certain kinds of advertisements, has actually wanted to protect users of the increasing the counseling example you to definitely all potential HECM individuals need sit in.

This new U.S. Company off Construction and you can Urban Advancement (HUD) makes it necessary that the possible HECM consumers over so it guidance class. HUD necessitates the advisors to help you outline the huge benefits and drawbacks regarding taking out a contrary mortgage.

Opposite home loan ads is relatively strictly managed, and you will a good amount of federal laws and regulations exclude lenders from while making inaccurate says within advertisements. These are generally the loan Acts and Means Adverts Signal (Control Letter), your situation from inside loans in North Washington the Credit Work (TILA), and User Financial Protection Act regarding 2010.

What’s a good example of Contrary Financial False Advertisements?

The new CFPB enjoys learned that reverse mortgage advertising remaining customers baffled on contrary mortgages becoming money, whether they was basically a national benefit, and you may whether or not they ensured that people you will definitely stay in their houses throughout their lifestyle.

Exactly who Handles Opposite Financial Organizations?

On federal level, the CFPB, brand new Agencies from Construction and you can Metropolitan Invention (HUD), additionally the Government Trade Percentage (FTC) handle reverse mortgage lenders’ issues. As well, specific says has introduced legislation one to manage how opposite mortgages was stated.

The conclusion

A number of state and federal statutes handle the way that contrary mortgage loans shall be advertised. They generate they unlawful for home loans, loan providers, servicers, and advertisements firms while making misleading states into the financial advertising and most other industrial interaction provided for users.