Approximately speaking, minimal payments 30 days into good $10,000 charge card restriction is approximately $3 hundred of income. $ cash four weeks you’ll cover around $45,000 regarding financial. From the bank’s vision, therefore, credit cards maximum ends you against credit and you will successfully maintenance one amount of money. Thus, if you a $20,000 bank card limit, that could reduce your borrowing from the bank by around $100,000, even although you avoid it.

How to handle mastercard limitations?

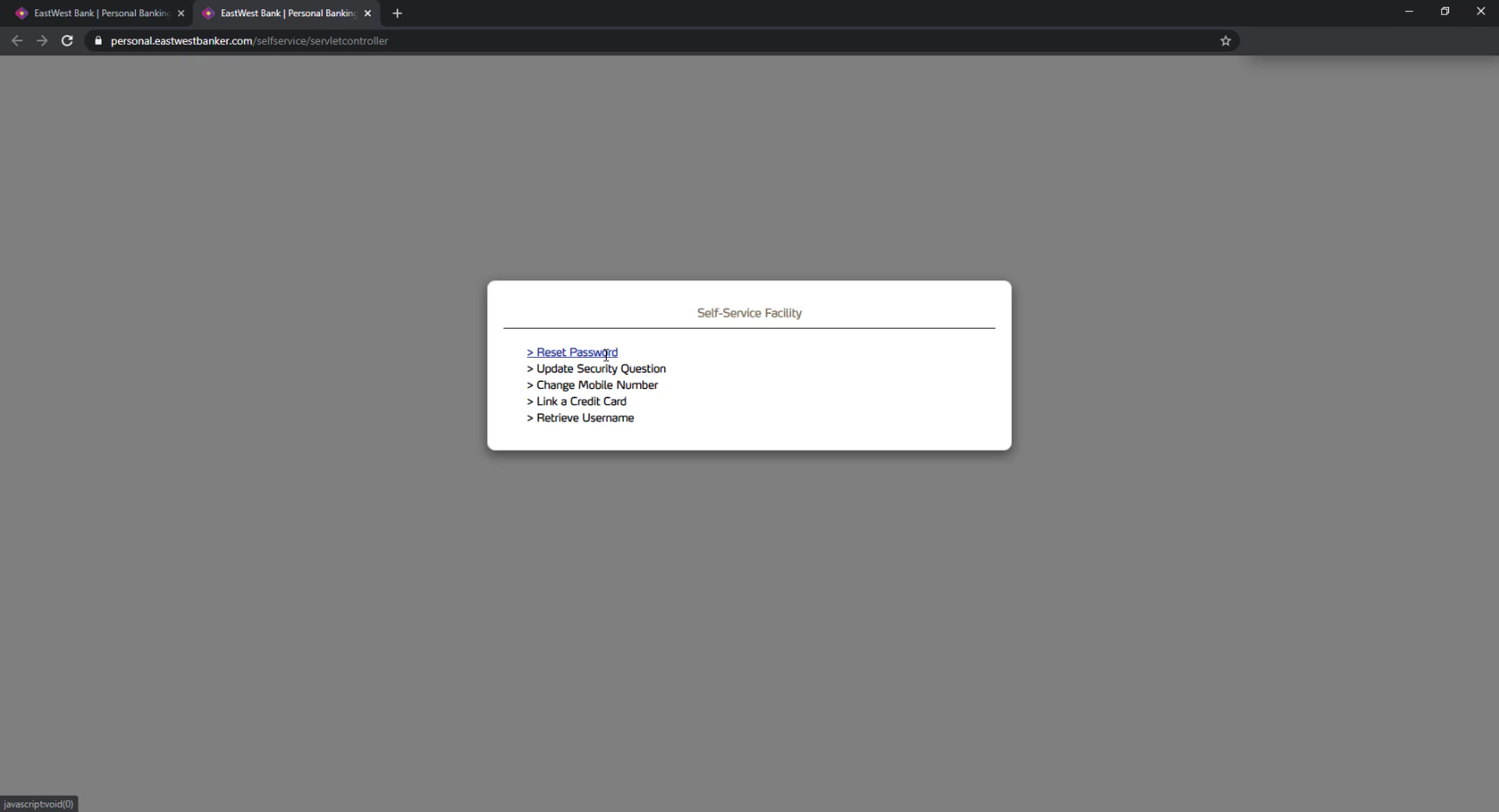

While you are against an income hurdle and therefore are incapable of have the mortgage you desire due to your earnings, after that reducing your credit card limitation otherwise cancelling it completely is really help. Simply phone call your own charge card provider and ask them to all the way down the credit limits or personal the newest membership. One plastic card you can expect to reduce your financial borrowing potential tremendously.

What to do about fico scores?

There are many different determinants away from a credit score, and many has actually a healthier dictate than the others. Each affect your rating decreases over the years, thereby credit more excess weight in order to new events.

You should control your borrowing sensibly and spend your own bills on time. Later, skipped or non-repayments, as well as judge penalties and fees, have an effective bad effect.

Paying personal credit card debt as soon as possible will assist keep the credit score in good shape. One option is to obtain a debt consolidation loan which have a reduced interest rate than simply your own bank card. You could potentially reduce interest and maybe pay off the total loans smaller.

It certainly is a good idea to be mindful of the quantity from borrowing monitors you’ve got complete. Inspections connected with applications or vehicle funding, particularly, normally negatively perception your credit rating. However, not all credit inspections are identical. New Zealand has 2 kinds of credit monitors: hard and soft. Hard borrowing checks are more total and are also typically did whenever you apply for borrowing. Silky credit checks, at the same time, is actually quicker total and are to own things such as bank card even offers otherwise done-by landlords and you will property administration people as an element of this new renter assessment techniques. Even though they do not have as frequently out of an effect on your credit rating, he could be however registered online payday loan Virginia on the credit history. When you have a number of flaccid borrowing from the bank inspections when you look at the an excellent little while, it may be considered a warning sign to a few loan providers.

One defaults loaded with a business on your credit assessment can be be the choosing grounds toward banking companies to help you thus no so you can the latest credit your seek when you may be effortlessly meeting the others lending criteria’s.

Making an application for a mortgage

If you have a dismal credit get, you might have to focus on improving they before you commonly efficiently rating home financing of a mainstream financial. While the accredited economic advisors, our team from the Around the globe Money can be direct you to increase your chances of a be mortgage and then we is also establish and argue the circumstances to you personally. Keep in touch with united states and you will probably understand what accomplish and you will exactly what will work to your advantage.

Everything and stuff had written on this site are genuine and direct towards better of the global Finance Qualities Ltd knowledge. Everything offered within the articles on this site shouldn’t be replaced with financial suggestions. Economic information needs to be looked for. No body or persons who count directly or indirectly abreast of recommendations in this article may keep Internationally Financial Services Ltd or their staff accountable.

A survey of several banking institutions because of the mortgage brokers and you can said inside the the latest Zealand Herald discovered that a couple making $130,000 annually and with a beneficial $100,000 deposit could find the quantity they might use quicker by the $47,000 given that they got a good $10,000 credit limit on their handmade cards. A great $15,000 limit you certainly will drop how much they may obtain of the $80,000 whenever you are a good $20,000 restrict you will definitely imply $100,000 faster.