Should you decide re-finance your financial to consolidate financial obligation?

Once you prefer Debt consolidation reduction Re-finance, it requires paying off higher-attention loans for a loan with less interest. Consolidating obligations enables you to save on interest repayments on long haul. Will set you back accumulates easily for those who owe a good amount of high-notice obligations, also it can become debilitating. For most, new apparent path is actually debt consolidating.

Already, financial pricing is at a nearly all-big date reduced, and a debt consolidation refinance could be an easy way so you’re able to save money. Prior to a decision into the debt consolidating, it’s important to read all that is at gamble and you can understand such five benefits. It’s imperative to detect what is a part of this type of methods given that protecting high-attention financial obligation against your house are risky, therefore weighing the pros and cons ahead of choosing.

How come debt consolidation performs?

High-focus personal debt are not comes from unsecured investment supplies, including signature loans and you will credit cards. Unsecured setting the lender includes zero surety to help you regain loss for many who drain with the personal debt. (In lieu of a mortgage, that’s secured by a concrete item; your residence.) It’s not hard to get into means more than your head with several high-attract costs getting provided for several lenders every month. Debt consolidation reduction Re-finance is a straightforward way when you have predictable money and would like to possess affordable monthly payments.

The purpose of a debt consolidation Refinance

An element of the goal of one debt consolidation reduction method is to possess even more in balance month-to-month can cost you. For the majority homeowners, a low-prices supply of money is their number one financial. People wanting https://paydayloancolorado.net/sanford/ to consolidate financial obligation will use a cash-out refinance. Debt consolidating pertains to closure into the a separate home loan worth alot more than simply your current home loan count. The excess loan amount are cashed away at your closing.

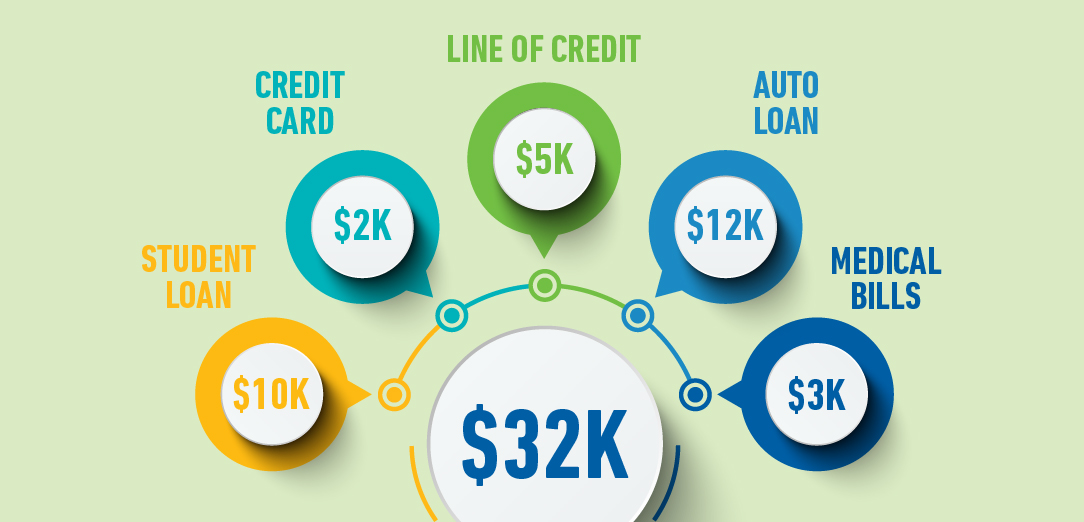

Next, make use of the newest cashed-away currency to pay off your highest-appeal personal debt, causing you to be which have a single debt to settle: your own home loan. With this specific station, you might be conclusively paying down expensive un-secured debts in the shape of a beneficial lower-focus home loan. Funds obtained while in the a profit-away re-finance are often used to pay-off other extreme financial obligation, instance scientific bills otherwise student loans.

If for example the most readily useful mission is to end up being debt-free quicker, then higher-notice costs will be take concern. The added benefit is the fact the current financial interest rates has reached near historic downs. So there is certainly a high probability you might lower your newest home loan rates and you will save on financial notice and also the focus on your own almost every other bills. Bear in mind that refinancing is sold with settlement costs, identical to together with your fresh mortgage.

Requirements regarding a debt settlement Refinance

So you can combine debt having fun with a home loan re-finance, you ought to be eligible for the latest mortgage. Standards vary according to your existing loan method of while the type of money-aside refinance youre making an application for.

Basic, you may need enough guarantee to settle current expenses. You’ll usually you desire more 20% security to help you be eligible for a debt consolidation home loan. Very lenders would like you to go out of no less than 20% of your home collateral untouched while using the a money-out re-finance. For-instance, 30-40% collateral is needed to cash out 10-20% in the bucks.

Additionally, you will need to meet minimal credit score requirements. The preferred variety of refinancing was a conventional cash-aside refinance, and it means a credit rating of at least 620.

FHA offers an earnings-out refinancing program, that enables a lower life expectancy FICO score of 600. Remember that taking right out a separate FHA loan function it is possible to purchase a home loan advanced (MIP), plus each other an upfront payment and a month-to-month home loan insurance policies commission. Which advances the total cost of the the latest loan and you may digs to your discounts margin.

A great choice for qualified experts and you will service users should be to combine debt via an effective Virtual assistant dollars-away refinance. This new Virtual assistant dollars-out mortgage allows you to re-finance 100% of one’s home’s most recent worth. Veterans might be considered even in the event they don’t have enough security to have a normal dollars-away financing.

Benefits associated with a debt negotiation Refinance

Debt consolidation are going to be an ingenious method of getting of personal debt smaller. Learn more about the 5 advantages of choosing a debt settlement refinance.

Benefit #step 1 Pay just you to bill per month

One of the most apparent advantages of merging financial obligation with a re-finance is having several costs lumped into the one percentage. So it work for is a great means to fix provide money month-to-month to save otherwise spend money on your next.

Benefit #2 Reduce your monthly obligations

Debt consolidating is actually ways to help make your day-to-times debt less costly by paying out to reveal a lower interest. Reducing your monthly installments is a superb way to

Work for #step three Replace your credit score

Combining the debt can also alter your credit rating. It helps by the cutting your borrowing from the bank usage ratio, the portion of your own total credit limit that you’re using each time.

Work with #cuatro Spend less through the elimination of the attention paid on the obligations

The most obvious benefit of a debt negotiation refinance would be the fact you can easily spend less of the decreasing the interest rate in your a good bills. This may save a good deal of money regarding the long run.

Work with #5 Reduce your current mortgage rate to keep towards home loan interest

Another benefit when you look at the finishing a debt consolidation refinance is always to conserve on your own modern financial focus. Of the consolidating your mortgage and you may expenses to each other in one, it can save you toward interest in the near future.

Overall, a debt settlement refinance are a smart way to expend down your debts from the a reduced interest. Nonetheless it demands a high rate from punishment to make money to eliminate negative effects.

Think about, you continue to are obligated to pay the bucks

Having a debt consolidation Refinance, you need to do so caution and become highly self-disciplined on your cost. You might place your house at risk if you can’t generate payments together with your home loan otherwise house equity-supported loan. Loanees occasionally enter dilemmas since their past lines of credit try freed upwards whenever their debt try consolidated. One may dish right up personal debt and now have into troubles most of the over again. Remember, merging does not always mean the money you owe had been cleaned brush. They truly are just becoming restructured becoming more possible. The greatest mission is always to stay debt-free; a beneficial re-finance or financing is just an approach to one end.

2nd strategies

Debt consolidation is actually a good path to get out of personal debt for the majority of consumers. Try to know the you’ll risks inside progress to get rid of them and you will pay down the debt victoriously.

- Realize make it possible to get month-to-month using habits manageable

- Generate increased-than-minimal payment on debts

- Think of a no-attract transfer or personal bank loan once the an alternative choice

Provides home loan questions? Trinity Oaks Home loan with pride provides the whole DFW Metroplex. Our very own experienced financing officials can be answer any financial-related issues you’ve got and you may show you through the techniques.