Financial borrowers that have a good credit score will get face highest will cost you not as much as good this new system away from federal home loan associations Fannie mae and you can Freddie Mac computer. The firms has actually released a new Mortgage Peak Price Modifications (LLPA) Matri x for funds offered in it after . Beneath the the brand new matrix, borrowers with high credit ratings have a tendency to face high mortgage fees than just ahead of and those that have down credit ratings commonly face all the way down fees.

“Its unprecedented,” David Stevens, an old government construction administrator and you will previous President of your own Mortgage Bankers Association, informed the new York Post. “My personal email address is complete regarding financial organizations and you may Chief executive officers [telling] me personally how unbelievably shocked he or she is from this move.”

However, an extra $forty four weeks setting a supplementary $480 annually. As well as over the whole course of mortgage payment, a citizen you will definitely finish using thousands of dollars much more due towards the percentage shift.

Regardless of how the fresh new change means with respect to actual can cost you, it appears to be unfair that borrowers which have fantastic borrowing from the bank was effortlessly being penalized if you’re individuals that have lower fico scores are increasingly being rewarded.

“This is a blatant and you can significant slashed out-of charge due to their highest-risk borrowers and a definite upsurge in best credit quality customers which just made clear to the world this particular flow try a beneficial quite extreme mix-subsidy rates change,” Stevens said.

“Full, lower-borrowing from the bank buyers tend to nevertheless pay much more into the LLPA charge than just higher-borrowing from the bank buyers but the most recent change often personal the gap,” notes the Post:

In the guidelines, high-credit customers which have scores ranging from 680 so you can more than 780 often come across an increase in their home loan costs with candidates just who lay 15% in order to 20% down payment exceptional greatest boost in charge….

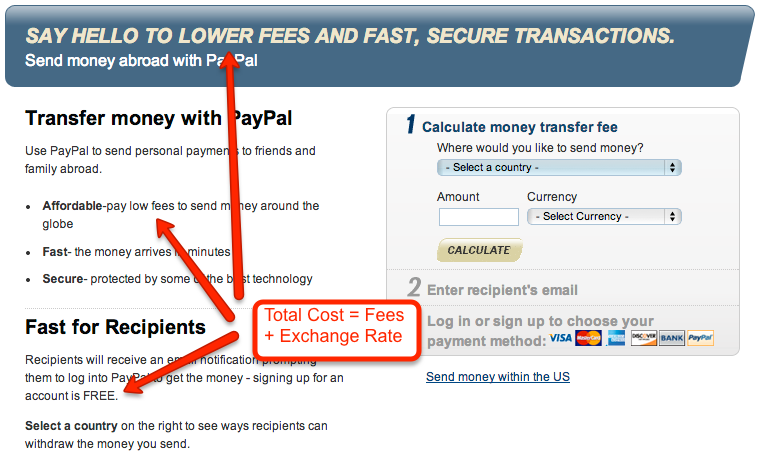

LLPAs are upfront charge according to activities instance an effective borrower’s credit history as well as the size of the downpayment. The fresh new charge are usually turned into payment issues that replace the consumer’s mortgage price.

Under the revised LLPA costs construction, a property customer that have good 740 FICO credit score and you can a beneficial 15% to 20% deposit usually face a-1% surcharge an increase off 0.750% compared to the old commission of only 0.250%….

At the same time, consumers which have credit ratings of 679 or lower will receive their charge clipped, leading to a whole lot more favorable home loan pricing. Instance, a purchaser with a great 620 FICO credit score with a down fee of 5% or smaller becomes a 1.75% fee dismiss a drop regarding dated fee rates away from step three.50% for this bracket.

By way of example, people which have a $eight hundred,000 loan and you may a six per cent financial speed get wind up purchasing on the $forty so much more monthly, according to Stevens’ calculations

Brand new productive penalty in order to have a credit rating not as much as 680 is actually today smaller than it absolutely was. They however can cost you a whole lot more to possess a reduced rating. For instance, when you yourself have a rating off 659 consequently they are borrowing 75% of the home’s worthy of, you’ll be able to spend a charge equivalent to step one.5% of your loan payday loan Dutton harmony while might pay zero payment for many who had a beneficial 780+ credit history. But before this type of alter, you’d enjoys paid an impressive dos.75% payment. Toward a beneficial hypothetical $300k mortgage, that’s a positive change regarding $3750 in conclusion costs.

Borrowers having high credit scores will generally feel spending a while over these people were beneath the early in the day structure

Elsewhere in the range, one thing had bad. …This won’t always leave their wallet initial since lenders can offer highest interest levels in many cases and you will spend such prices for you (nevertheless costs are nevertheless there, but still officially getting paid down on your part throughout the years on particular large interest levels).