Just what You will see

You have heard of the brand new Government Homes Management (FHA) financing americash loans Axis being an excellent chance, specifically for earliest-day homeowners. And is also! With only good 3.5% downpayment expected and a lot more flexible certificates getting borrowing and you can earnings, FHA loans unlock doorways for the majority of buyers. Let’s take a look at why…

What’s the FHA Financing?

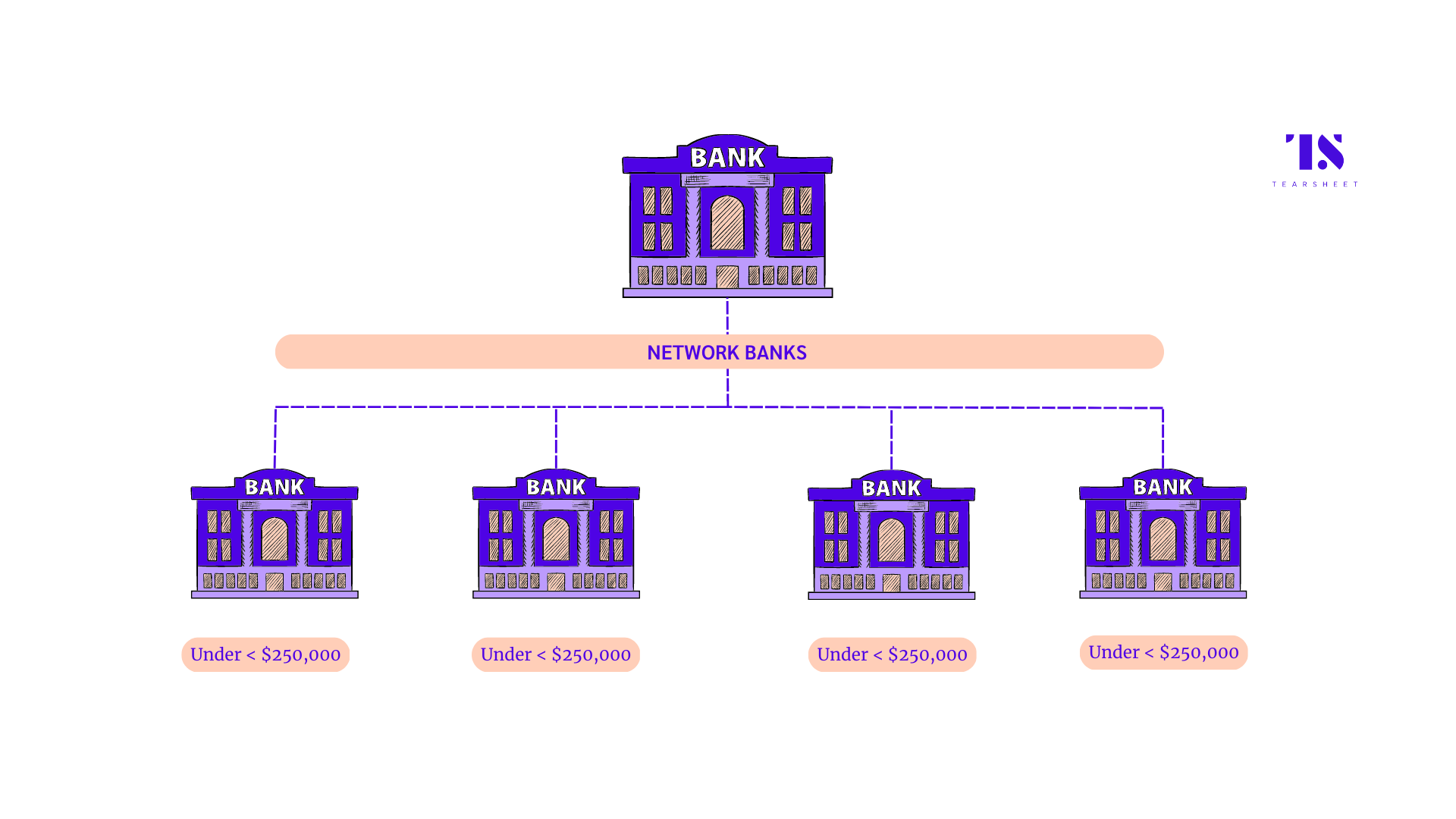

Given because of the You.S. Agency out-of Construction and you will Metropolitan Invention (HUD), the new FHA is created in the new 1930s so you can insure mortgage loans and you will let stimulate the new housing market during the High Depression. Just people financial could possibly offer FHA funds they have to be acknowledged first. Because FHA secures the loan, you can enjoy:

You could qualify for an enthusiastic FHA mortgage with only 3.5% off and you will a credit score as low as 580 (Atlantic Bay’s demands is actually 600). This is not to declare that all earliest-go out homeowners have little saved for their down payment or has a rocky credit history. But the FHA loan’s independency was a plus just in case you would require some freedom that have both of these certification.

You can find several FHA programs available. Homeowners should buy step one-cuatro tool qualities, no very first-go out visitors specifications. If you wish to purchase a fixer-upper, the fresh new FHA also provides restoration funds and for additional energy improvements brand new FHA Energy-Effective Home loan program. And also the FHA mortgage is available on the are manufactured property and facility-established construction, as well.

FHA Home loan Insurance coverage

Today this is actually the kicker. Since the FHA has no need for a massive deposit, there’s some exposure getting a lender regardless if a homeowner ends and also make repayments. Very, this new FHA loan boasts financial insurance premiums (MIP). For folks who set-out at least 10%, it is possible to only have to spend MIP towards the earliest eleven decades of one’s loan name; less than 10% down mode you are able to shell out MIP on the longevity of the loan.

There have been two FHA mortgage MIPs: an initial advanced and a supplementary annual payment. The amount you’ll pay money for one another depends on the loan amount.

Brand new initial MIP fee was step 1.75% of your loan’s worth. Particularly, for folks who obtain $2 hundred,000 to suit your home loan, you’ll want to create an upfront payment from $step 3,500 in the closure. You could move it into the loan which means you you should never have to pay it from pocket.

The new annual MIP utilizes your loan-to-value ratio (aka, LTV – an evaluation amongst the loan amount together with value of brand new domestic you happen to be to buy), their deposit amount, your own loan’s term, while the amount borrowed. The debtor varies, but generally speaking, brand new yearly MIP was .50-.55% of your own total amount borrowed, split by 12 months, and you will set in the payment per month.

This new FHA allows down payment and you will closure rates help from next mortgages and you will give applications, in addition to provide funds from friends and family.

Atlantic Bay has the benefit of one or two downpayment recommendations applications, Chenoa and you may Customer Boost, which each other help with the three.5% down-payment therefore the desired FHA settlement costs (around 6% of the cost otherwise assessment really worth, whatever is lower). Occasionally, this type of apps can make an excellent 100% combined financing-to-worth FHA mortgage definition your give little, if any, bucks to shut.

FHA Financing Eligibility Requirements

We’ve mentioned a few requirements, such as for example an effective 580 credit score and the step three.5% downpayment, but check out much more certificates you will need to meet to own an FHA financing:

An obligations-to-earnings (DTI) ratio from 43% or less. It indicates your own home loan expense in addition to any month-to-month loans (auto loan, student loan, handmade cards, unsecured loans, etcetera.) can not be more 43% of the revenues

You should meet the financing maximum centered on your part (you can search your venue and you can limitation on FHA’s site

New Chenoa Financing system is out there because of the CBC Mortgage Agency and you can the above mentioned recommendations are not that from Atlantic Bay Home loan Category, L.L.C. Data is to have informative intentions simply and should not be relied on on your part. Minimum credit history restrictions implement. Almost every other lender, financing program, and you will state-particular restrictions s can get alter at any time that have otherwise instead of find. All of the funds at the mercy of earnings verification, credit approval, and you will assets assessment. Not a relationship so you’re able to provide. Suggestions considered reliable but not secured. Atlantic Bay Mortgage Category, L.L.C. NMLS #72043 (nmlsconsumeraccess.org) is the same Chance Lender. Located at 600 Lynnhaven Parkway Room 100 Virginia Coastline, Virtual assistant 23452.