Home loan advertisements try a seriously controlled part of the monetary attributes sector. Partly, that is because property is usually the unmarried biggest get that all people will ever create.

Wide Controls

To end unscrupulous loan providers away from taking advantage of consumers, home loan advertisements try controlled by government rules. The first of those regulations may be the Home loan Serves and you can Practices Ads Rule (Maps Signal), the fact when you look at the Credit Operate (TILA), therefore the Individual Economic Cover Work regarding 2010.

The fresh new Maps Code, called Control N, regulation the way in which mortgage functions as a whole is said, and work out deceptive states illegal.

Certain FHA Opposite Mortgage Regulation

While doing so, there are statutes one to implement especially to help you contrary mortgage loans. The majority of the contrary mortgages in the united states try domestic equity transformation mortgage loans (HECMs), that Federal Casing Management (FHA) assures.

The fresh new FHA regulates new adverts away from FHA-supported financing possesses certain laws and regulations for contrary mortgages. Less than FHA rules, loan providers have to define the requirements featuring of your HECM program in the clear, consistent words so you can users.

Federal statutes per contrary financial advertising is overseen of the Federal Change Commission (FTC) additionally the CFPB, all of having removed step facing of a lot lenders to possess untrue says associated with the opposite home loan advertisements.

The fresh new CFPB appetite more mature People in the us to watch out for misleading or complicated opposite financial ads. People need to keep at heart one an other mortgage is an excellent loan, you to definitely ads will be mistaken, and that without a plan, you could outlive the bucks loaned.

State Guidelines for the Opposite Financial Advertisements

And federal rules, numerous states has introduced laws and regulations you to definitely reduce way in which opposite mortgage loans shall be claimed.

Any of these rules, such as those within the New york and you may Tennessee, endeavor to then maximum the ability of contrary mortgage brokers to help you misrepresent just how these money work.

Others, like the laws and regulations in place inside Oregon, identify and require a lot of disclosures-extremely important items of suggestions the lender need to express towards the possible borrower-and you can identify that these must be preferred and not simply appear on terms and conditions.

Many states, as opposed to prohibiting certain kinds of ads, has tried to protect consumers because of the enhancing the guidance course one all-potential HECM individuals need attend.

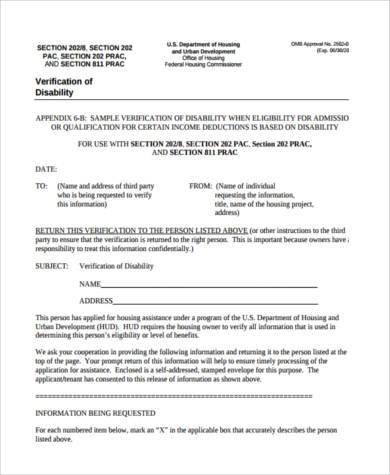

The brand new U.S. Department regarding Houses and Urban Innovation (HUD) makes it necessary that all of the possible HECM individuals over that it guidance lesson. HUD requires the advisors to help you outline the advantages and you will disadvantages from taking out fully a face-to-face mortgage.

Opposite mortgage ads is relatively strictly managed, and many federal laws exclude loan providers from while making inaccurate says within advertising. These are generally the borrowed funds Serves and you will Means Advertisements Code (Regulation Letter), the situation into the Credit Work (TILA), and the Individual Economic Shelter Operate out-of 2010.

What is actually an example of Contrary Financial Incorrect Advertisements?

Brand new CFPB features unearthed that opposite home loan advertisements left customers perplexed in the opposite mortgage loans are fund, whether or not they had been a government work for, and you may if they ensured one customers you will definitely stay static in their homes for the rest of their lives.

Just who Handles Reverse Financial People?

At the federal peak, the newest CFPB, the fresh new Agencies off Housing and Metropolitan Advancement (HUD), additionally the Government Trading Fee (FTC) regulate opposite financial lenders’ items. On the other hand, some says enjoys passed regulations you to manage exactly how contrary mortgages try advertised.

The conclusion

A great amount of federal and state regulations handle the way reverse mortgage loans is going to be said. They generate they against the law getting home loans, lenders, servicers, and you can adverts organizations and come up with misleading states when you look at the financial marketing other industrial communications provided for customers.